Uber Mileage Log Template

Uber Mileage Log Template - Web uber mileage log template mileage log templates free download mileage records are likewise used to reveal to us what number of kilometers a vehicle has run, additionally, disclose to us the time taken by vehicle (particular time) mileage log layout can likewise ascertain your mileage in days, week, months too. Every time i end my dash, i update my dasher tracker spreadsheet through my google drive app. Our free mileage track template is perfect for all the business needs. Date of drives starting and end points mileage of drives business purpose of the trip. Tracking your mileage can save you thousands on your taxes (even more if you use an automatic mileage tracker app !). Web at the standard mileage rate of 62.5 cents per mile (for the second half of 2022), that lets you knock a lot of money off your tax bill. Below are 19 incredible mileage log book apps for uber and lyft drivers you can choose from. Web what do i need for my uber mileage log? Pdf license:free for educational purpose. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Our online mileage log generator helps you make mileage logs in a matter of minutes. Does uber track your miles for you? These free excel mileage logs contain everything you need for a compliant irs mileage log.. Web at the standard mileage rate of 62.5 cents per mile (for the second half of 2022), that lets you knock a lot of money off your tax bill. Bratislav milojevic | elmed d.o.o. Web what do i need for my uber mileage log? Date of drives starting and end points mileage of drives business purpose of the trip. Our. We'll talk about how to track miles for doordash, uber eats, uber, lyft, instacart, and all the other gig economy apps: Keep reading if you need help with calculating your actual expenses instead—our app can help get things rolling. 12/11/2019 8:06:42 pm other titles Template features include sections to list starting and ending locations, daily and total miles driven, employee. Web take a look at this excellent example of a driving log made by an uber driver. Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer.. These free excel mileage logs contain everything you need for a compliant irs mileage log. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Web uber mileage log template mileage log templates free download mileage records are likewise used to reveal to us what number of. When you take the mileage deduction, the irs wants a contemporaneous record of your drives. But say you forgot to keep track of them yourself. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. To determine whether your mileage is deductible, we recommend contacting an independent tax professional for any tax questions you. Do you need a mileage log for reimbursement or irs tax purposes? Web take a look at this excellent example of a driving log made by an uber driver. We'll talk about how to track miles for doordash, uber eats, uber, lyft, instacart, and all the other gig economy apps: To determine whether your mileage is deductible, we recommend contacting. Web january 24, 2022 if you drive for uber, you can save a lot on your taxes by writing off the miles you log on the job. Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. Web what do i need for my uber mileage log? All in all,. Bratislav milojevic | elmed d.o.o. Web download our free printable mileage log templates, forms and samples! 31 high quality mileage log templates in excel, word or pdf Bratislav milojevic | elmed d.o.o. File size:220 kb download file type:winrar (pdf) to use this pdf file you need adobe download uber mileage log example template | free printable. Your mileage log must include: To determine whether your mileage is deductible, we recommend contacting an independent tax professional for any tax questions you may have, as uber does not provide tax. But say you forgot to keep track of them yourself. Bratislav milojevic | elmed d.o.o. Date, destination, business purpose, odometer start, odometer stop, miles this trip, expense type,. Try bonsai's free mileage tracker templates to quickly organize your miles and start saving money! Web uber mileage log template mileage log templates free download mileage records are likewise used to reveal to us what number of kilometers a vehicle has run, additionally, disclose to us the time taken by vehicle (particular time) mileage log layout can likewise ascertain your mileage in days, week, months too. Web this monthly mileage report template can be used as a mileage calculator and reimbursement form. We'll talk about how to track miles for doordash, uber eats, uber, lyft, instacart, and all the other gig economy apps: Our online mileage log generator helps you make mileage logs in a matter of minutes. Web whichever method you choose to use to deduct your taxes, you will need a reliable mileage log book app to help you track your miles and provide evidence. Web we've created a free mileage tracker template that will make it easy for you to keep track of your business mileage. Web january 24, 2022 if you drive for uber, you can save a lot on your taxes by writing off the miles you log on the job. Bratislav milojevic | elmed d.o.o. Web need a mileage log template that meets irs reference? Date, destination, business purpose, odometer start, odometer stop, miles this trip, expense type, expense amount. Web if you plan on tracking your miles to deduct from thine taxes, you'll need clean records till submit until the scrip to justify your output. Tracking your mileage can save you thousands on your taxes (even more if you use an automatic mileage tracker app !). Web download our free printable mileage log templates, forms and samples! In this article, we'll walk you through how to properly track miles for taxes and use our free template. File size:220 kb download file type:winrar (pdf) to use this pdf file you need adobe download uber mileage log example template | free printable. Your mileage log must include: Our free mileage track template is perfect for all the business needs. Keep reading if you need help with calculating your actual expenses instead—our app can help get things rolling. Every time i end my dash, i update my dasher tracker spreadsheet through my google drive app. Web whichever method you choose to use to deduct your taxes, you will need a reliable mileage log book app to help you track your miles and provide evidence. Every time i end my dash, i update my dasher tracker spreadsheet through my google drive app. Web at the standard mileage rate of 62.5 cents per mile (for the second half of 2022), that lets you knock a lot of money off your tax bill. To determine whether your mileage is deductible, we recommend contacting an independent tax professional for any tax questions you may have, as uber does not provide tax. This is commonly called a mileage log template. Web check out our uber mileage log selection for the very best in unique or custom, handmade pieces from our shops. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. This is from irs pub. Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. When you take the mileage deduction, the irs wants a contemporaneous record of your drives. The uber app attempts to record all your “online miles” — the miles you drive while you have the app open. 31 high quality mileage log templates in excel, word or pdf File size:220 kb download file type:winrar (pdf) to use this pdf file you need adobe download uber mileage log example template | free printable. Web you can elect to use the standard mileage rate if you used a car for hire (such as a taxi) unless the standard mileage rate is otherwise not allowed, as discussed above. i underlined certain part. Web uber mileage log template mileage log templates free download mileage records are likewise used to reveal to us what number of kilometers a vehicle has run, additionally, disclose to us the time taken by vehicle (particular time) mileage log layout can likewise ascertain your mileage in days, week, months too. Date of drives starting and end points mileage of drives business purpose of the trip.FREE 17+ Sample Mileage Log Templates in MS Word MS Excel Pages

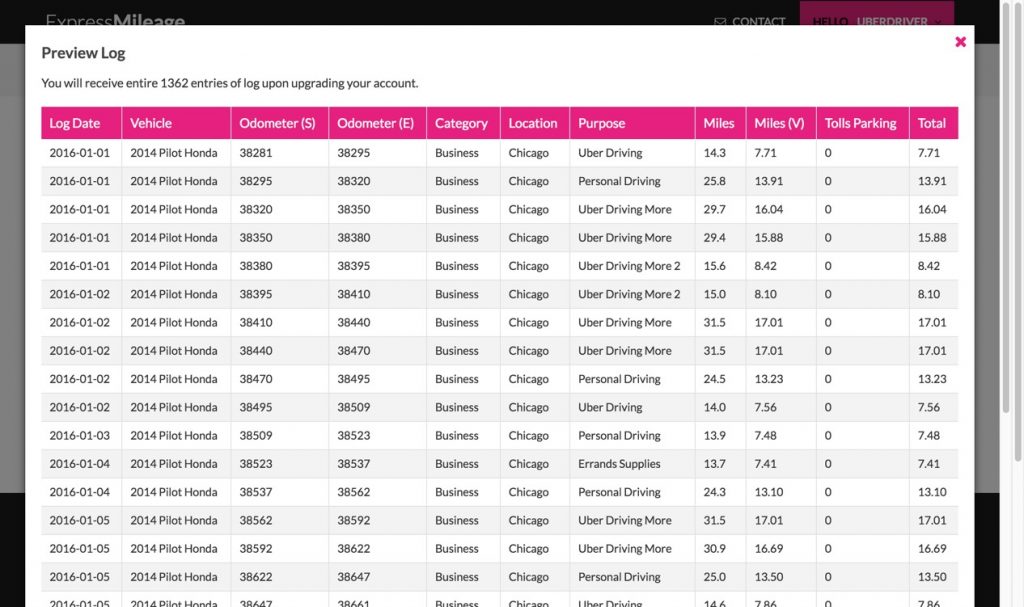

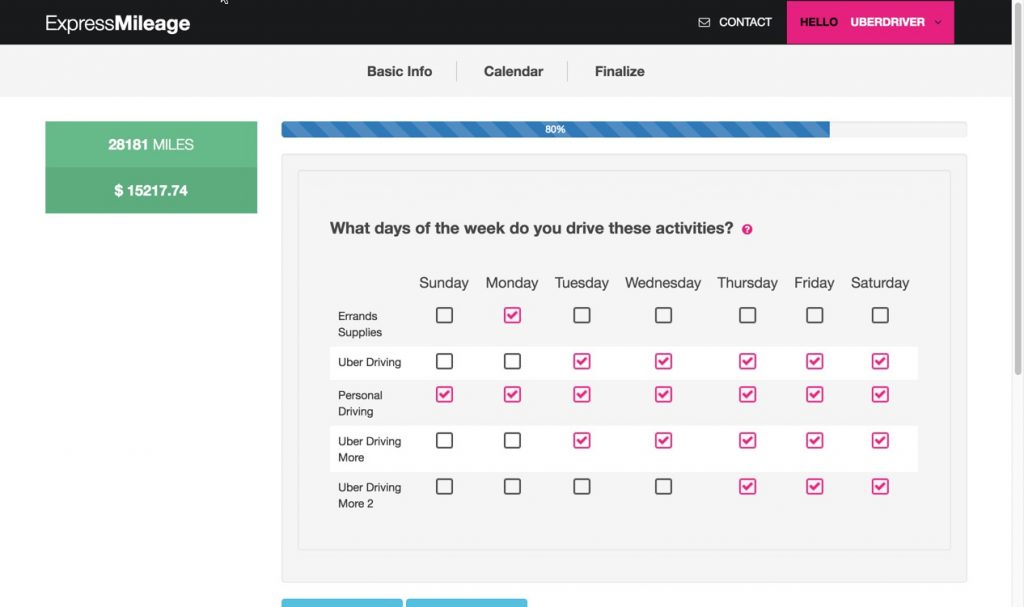

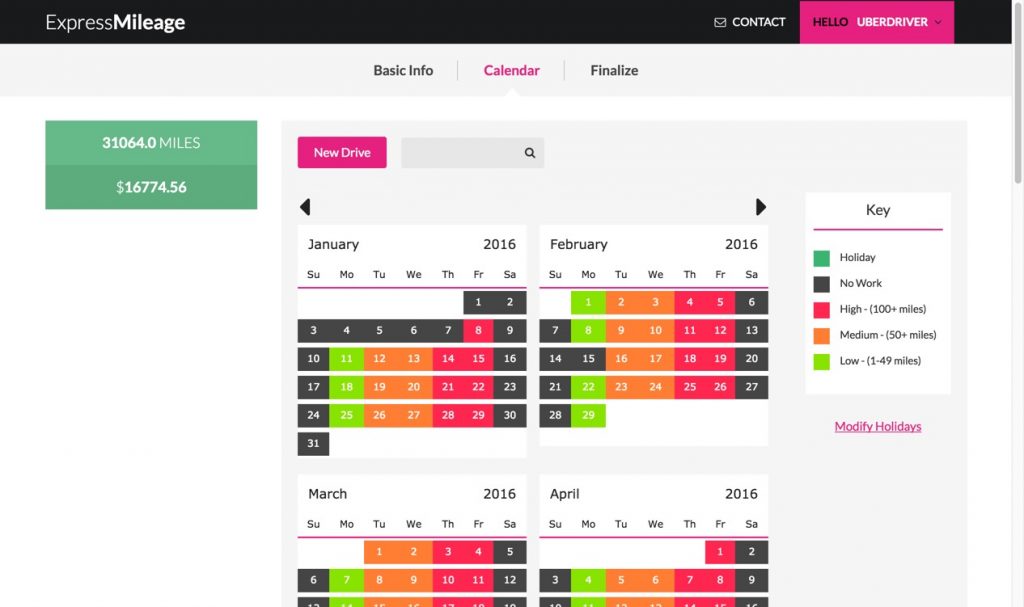

How to Create an UBER Mileage Log ExpressMileage

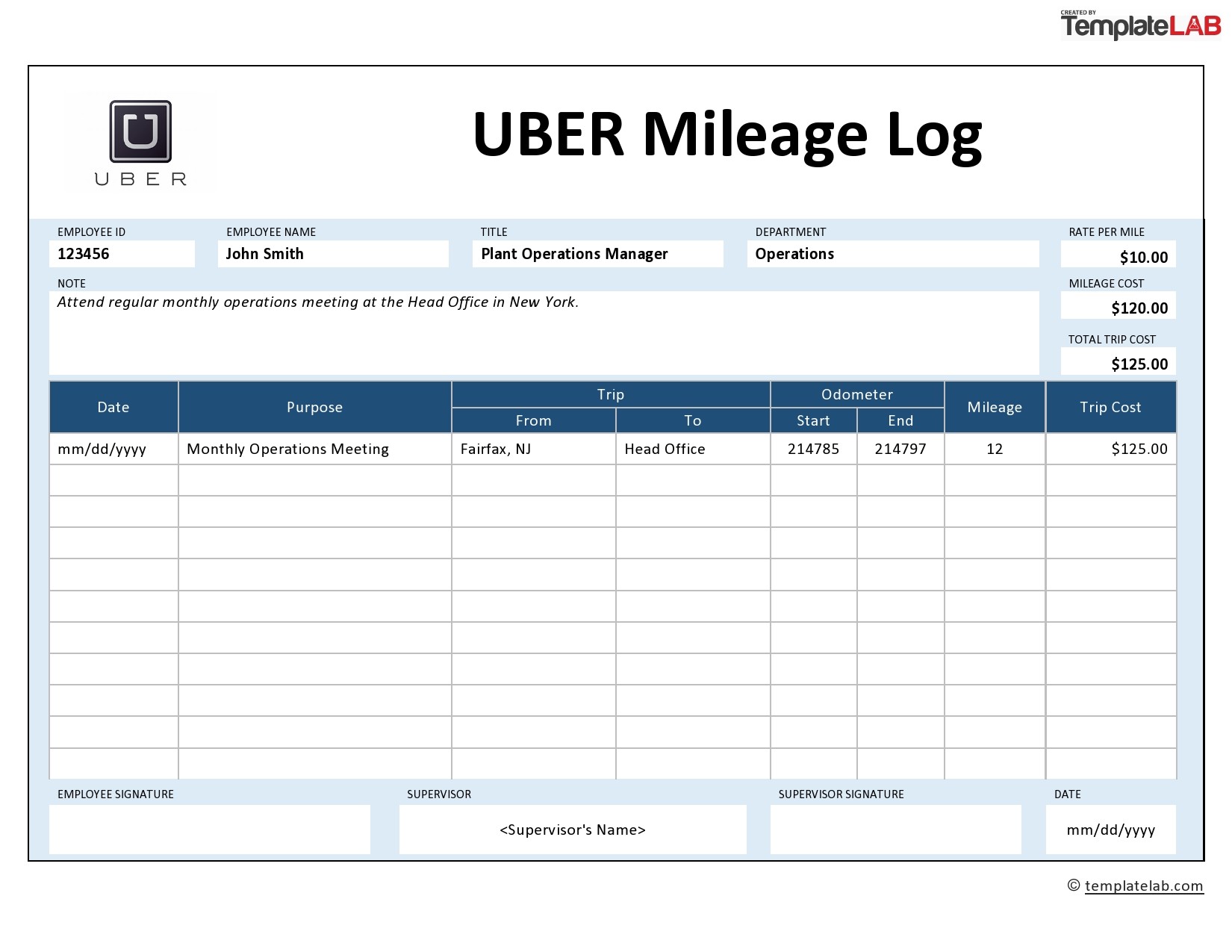

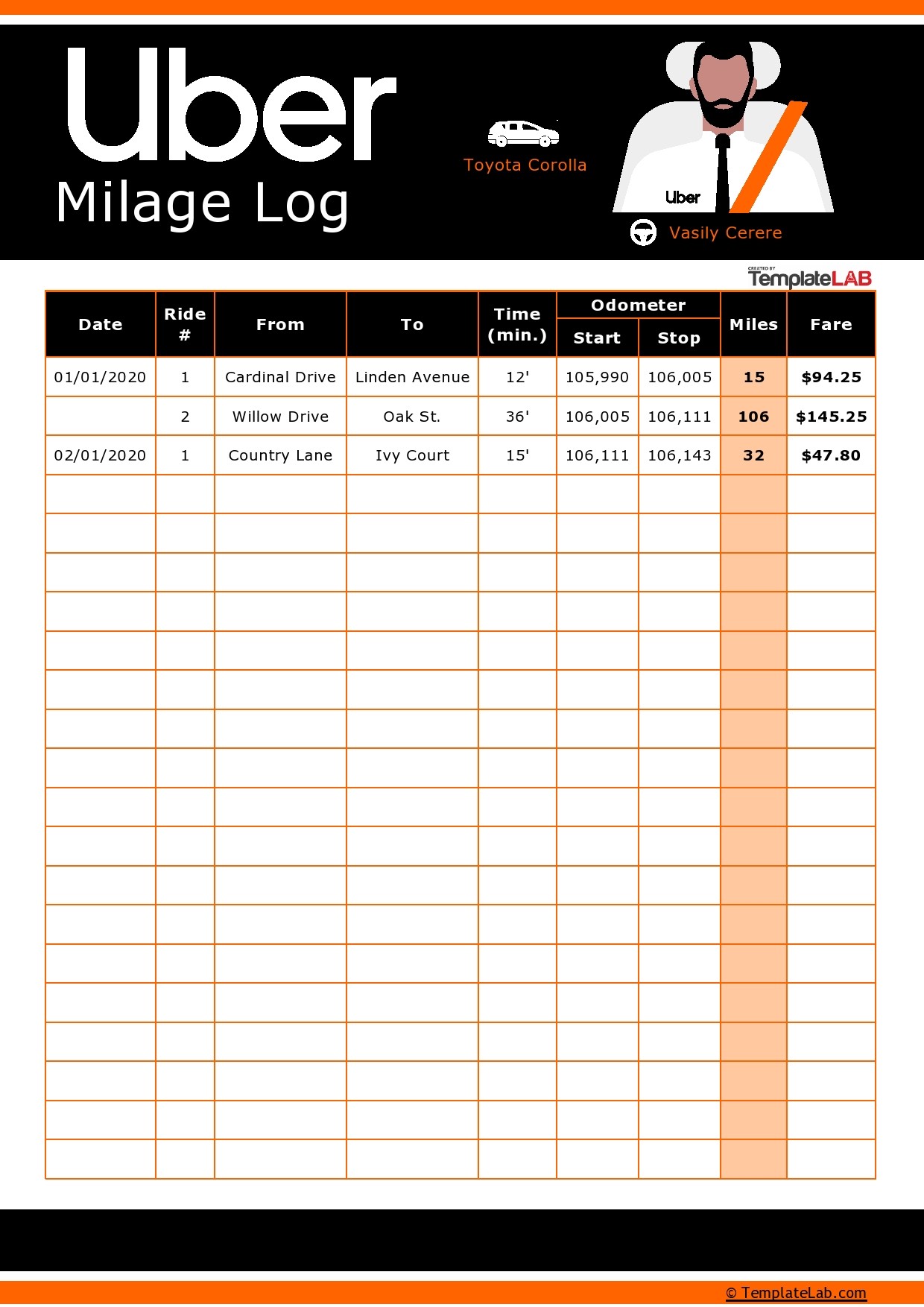

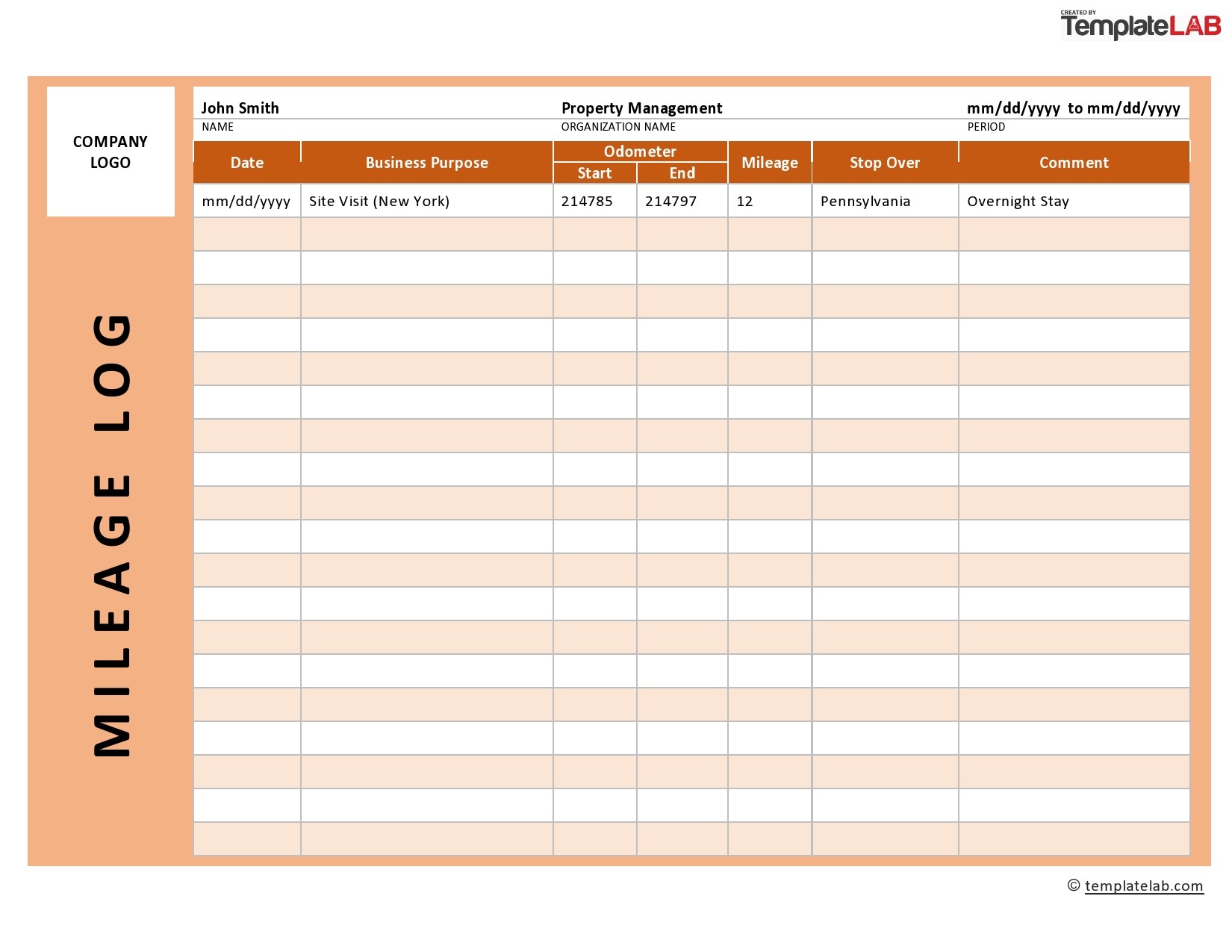

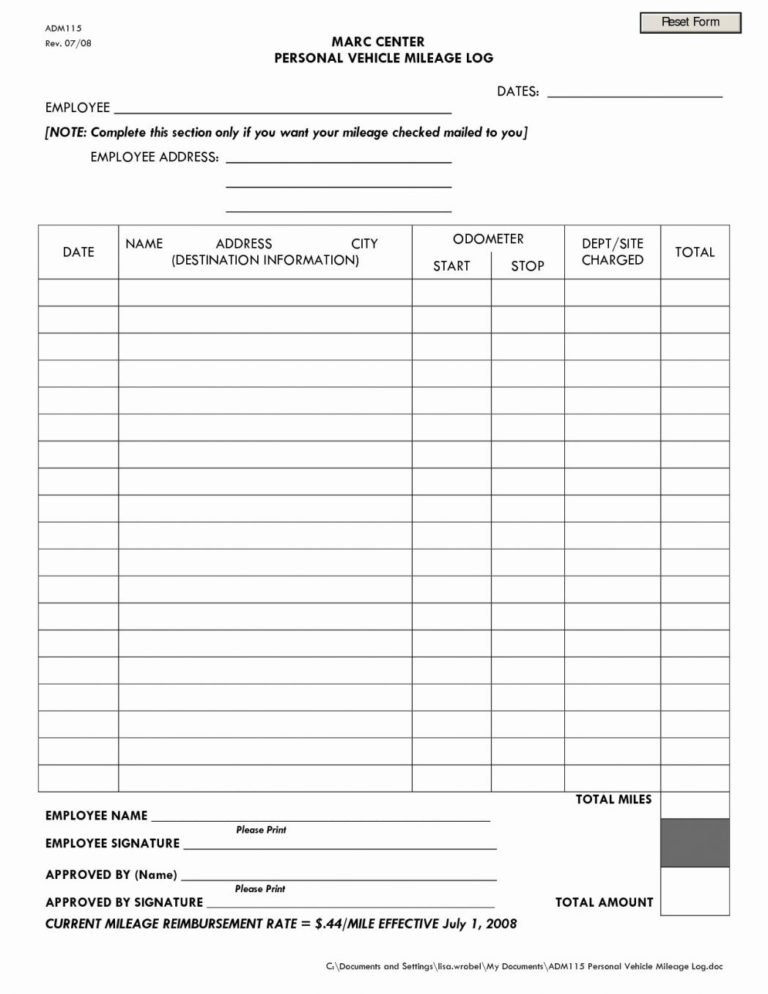

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

How to Create an UBER Mileage Log ExpressMileage

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab Mileage

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

How to Create an UBER Mileage Log ExpressMileage

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Rideshare Spreadsheet intended for Mileage Spreadsheet For Taxes Lovely

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Sarah York, Ea Updated March 29, 2023.

Date, Destination, Business Purpose, Odometer Start, Odometer Stop, Miles This Trip, Expense Type, Expense Amount.

Failure To Track Miles Can Be An Expensive Mistake.

Web Need A Mileage Log Template That Meets Irs Reference?

Related Post: