Printable Itemized Deductions Worksheet

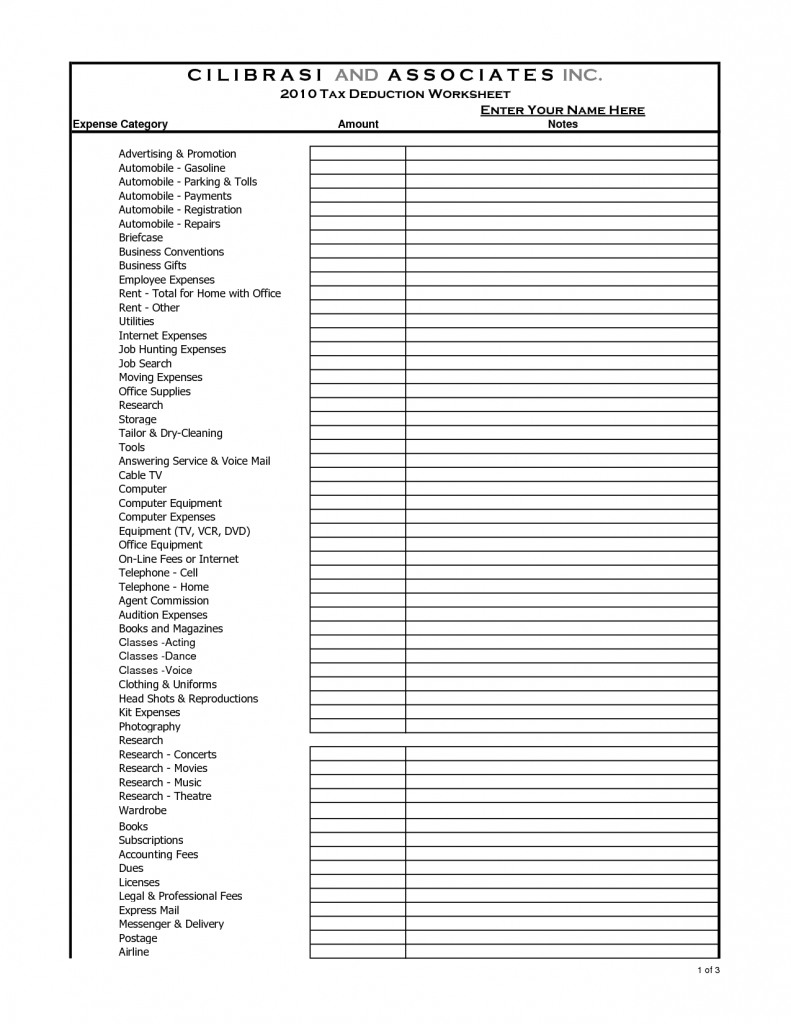

Printable Itemized Deductions Worksheet - $315,300 if head of household;. Schedule a itemized deductions 2. With a simple net search, you. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Tax deductions for calendar year 2 0 ___ ___ hired$___________help. Web download or print the 2022 federal (itemized deductions) (2022) and other income tax forms from the federal internal revenue service. The source information that is required for each tax. Web this worksheet allows you to itemize your tax deductions for a given year. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Easily fill out pdf blank, edit, and sign them. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. 30 enter the larger of the amount on line 29 or your standard deduction. Web printable itemized deductions worksheets are a efficient and also convenient tool for children, parents, and instructors alike. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29.. Web complete printable itemized deductions worksheet online with us legal forms. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Web printable itemized deductions worksheets are a efficient and also convenient tool for children, parents, and instructors alike. 30 enter the larger of the amount on line 29 or your standard deduction. The source. Itemized deduction worksheet tax year 5. Save or instantly send your ready documents. The source information that is required for each tax. Save or instantly send your ready. Easily fill out pdf blank, edit, and sign them. Web using your federal filing status, if the amount on line 1 of forms 760, 760py, or 763 exceeds $343,950 if jointly or qualifying widow(er); The source information that is required for each tax. Itemized deduction worksheet tax year 5. Tax deductions for calendar year 2 0 ___ ___ hired$___________help. Schedule a itemized deductions 2. Web download or print the 2022 federal (itemized deductions) (2022) and other income tax forms from the federal internal revenue service. With a simple net search, you. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. $315,300 if head of household;. Web this worksheet allows you to itemize your tax deductions for. The source information that is required for each tax. 30 enter the larger of the amount on line 29 or your standard deduction. With a simple net search, you. Easily fill out pdf blank, edit, and sign them. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Schedule a itemized deductions 2. Web this worksheet allows you to itemize your tax deductions for a given year. Easily fill out pdf blank, edit, and sign them. $315,300 if head of household;. With a simple net search, you. Easily fill out pdf blank, edit, and sign them. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): 30 enter the larger of the amount on line. Web complete printable itemized deductions worksheet online with us legal forms. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. 30 enter the larger of the amount on line 29 or your standard deduction. Web using your federal filing status, if the amount on line 1 of forms 760, 760py, or 763. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Web printable itemized deductions worksheets are a efficient and also convenient tool for children, parents, and instructors alike. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Web download or print the 2022 federal (itemized deductions) (2022) and other. Web this worksheet allows you to itemize your tax deductions for a given year. With a simple net search, you. $315,300 if head of household;. Web download or print the 2022 federal (itemized deductions) (2022) and other income tax forms from the federal internal revenue service. Web using your federal filing status, if the amount on line 1 of forms 760, 760py, or 763 exceeds $343,950 if jointly or qualifying widow(er); The source information that is required for each tax. 30 enter the larger of the amount on line 29 or your standard deduction. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. Web complete printable itemized deductions worksheet online with us legal forms. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Web printable itemized deductions worksheets are a efficient and also convenient tool for children, parents, and instructors alike. Tax deductions for calendar year 2 0 ___ ___ hired$___________help. Easily fill out pdf blank, edit, and sign them. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Schedule a itemized deductions 2. Itemized deduction worksheet tax year 5. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Save or instantly send your ready. Itemized deduction worksheet tax year 5. With a simple net search, you. Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Save or instantly send your ready. Web this worksheet allows you to itemize your tax deductions for a given year. Web printable itemized deductions worksheets are a efficient and also convenient tool for children, parents, and instructors alike. Web download or print the 2022 federal (itemized deductions) (2022) and other income tax forms from the federal internal revenue service. Save or instantly send your ready documents. Schedule a itemized deductions 2. Easily fill out pdf blank, edit, and sign them. Tax deductions for calendar year 2 0 ___ ___ hired$___________help. 30 enter the larger of the amount on line 29 or your standard deduction. $315,300 if head of household;. Web complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29. The source information that is required for each tax. Web using your federal filing status, if the amount on line 1 of forms 760, 760py, or 763 exceeds $343,950 if jointly or qualifying widow(er);itemized deductions worksheet template

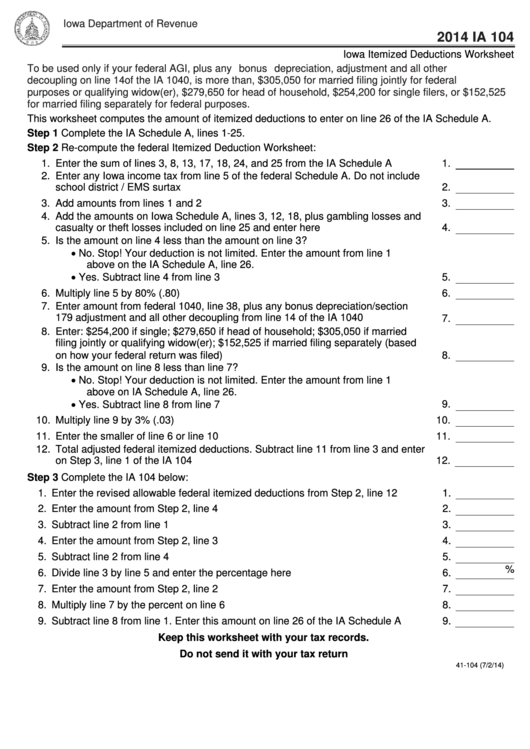

Form Ia 104 Iowa Itemized Deductions Worksheet 2014 printable pdf

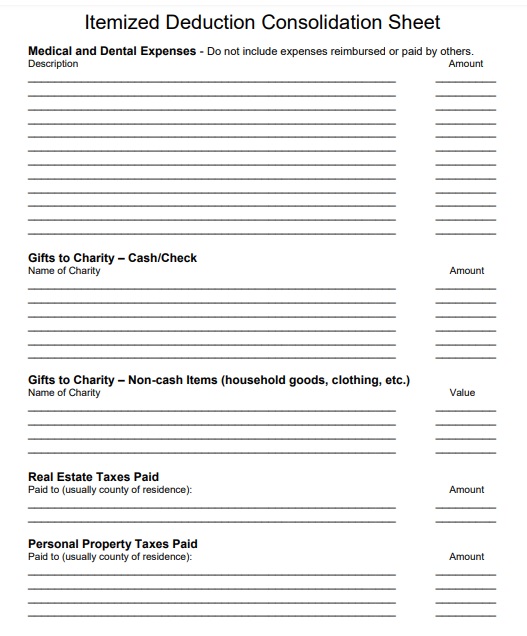

Itemized Deduction Templates 8+ Printable Word & PDF Formats

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

10 2014 Itemized Deductions Worksheet /

5 Itemized Tax Deduction Worksheet /

30++ Itemized Deduction Small Business Tax Deductions Worksheet

Itemized Deductions Worksheet 2018 Printable Worksheets and

Printable Yearly Itemized Tax Deduction Worksheet Fill Online

8 Tax Itemized Deduction Worksheet /

Web We’ll Use Your 2022 Federal Standard Deduction Shown Below If More Than Your Itemized Deductions Above (If Blind, Add $1,750 Or $1,400 If Married):

Web Complete Printable Yearly Itemized Tax Deduction Worksheet Online With Us Legal Forms.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web Complete Printable Itemized Deductions Worksheet Online With Us Legal Forms.

Related Post: