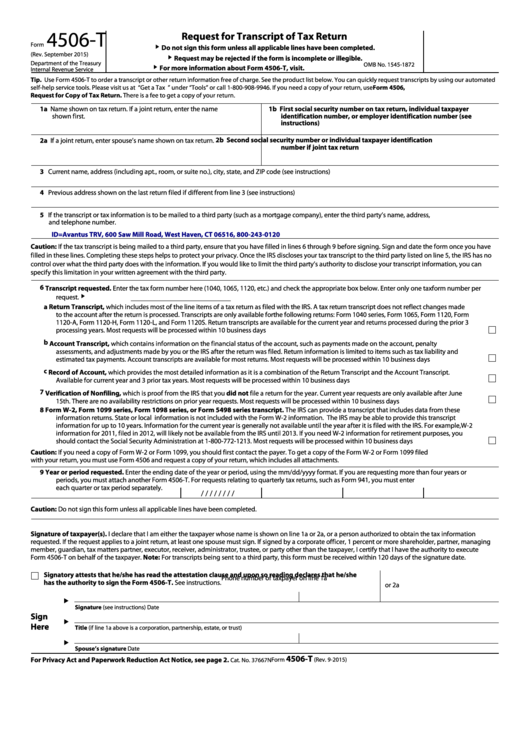

Printable 4506 T Form

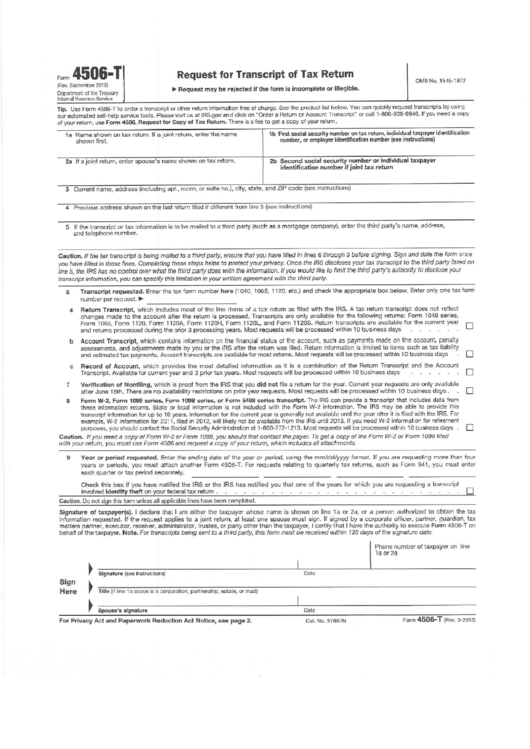

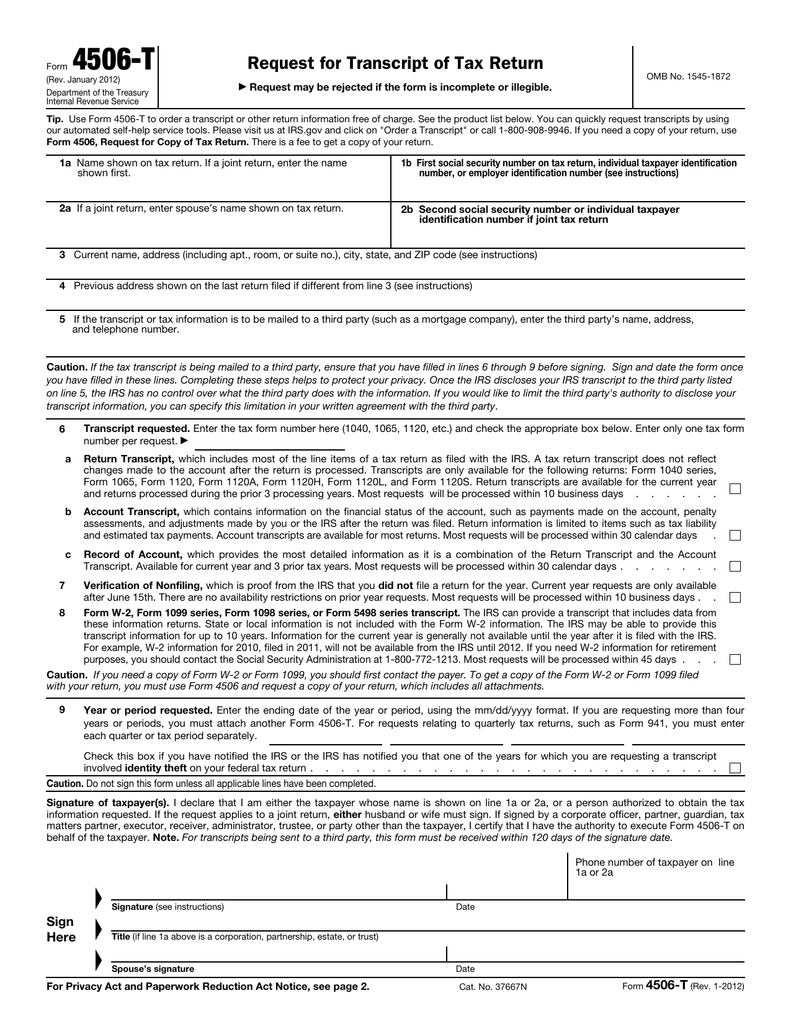

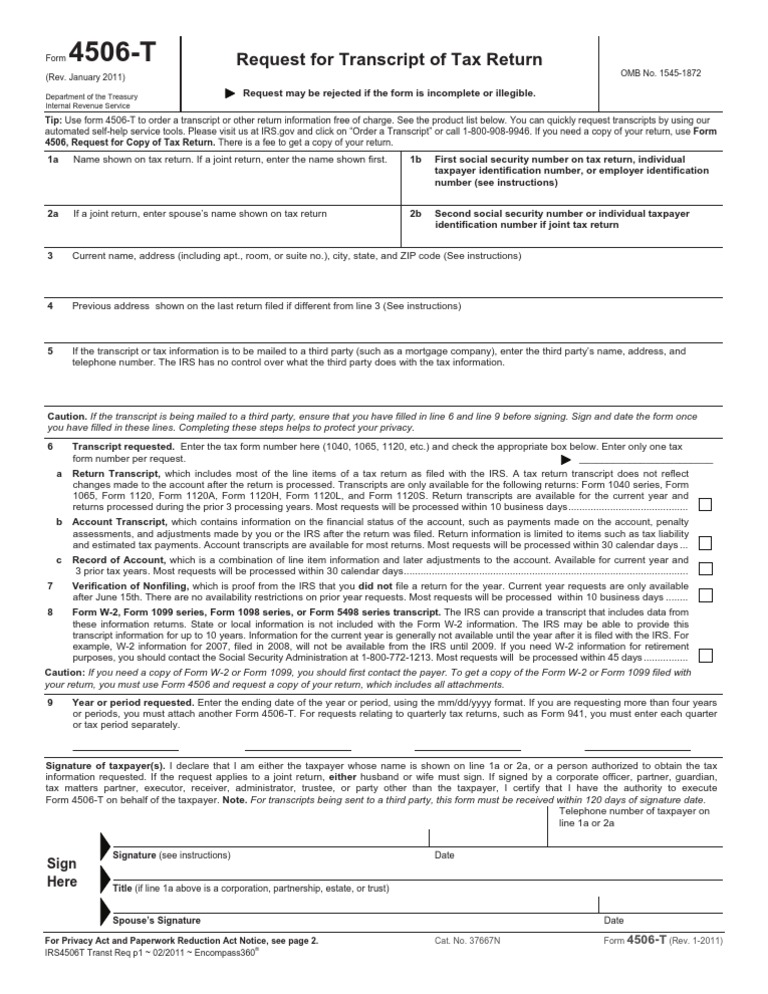

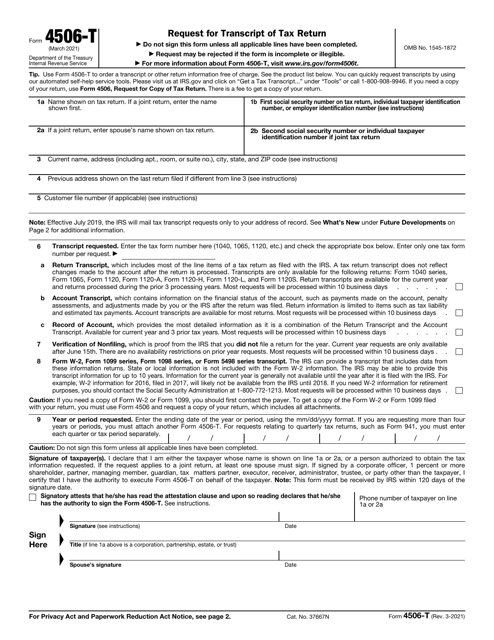

Printable 4506 T Form - Request may be rejected if the form is incomplete or illegible. People can also use this form to request that. See the product list below. The transcript format better protects taxpayer data by partially masking personally identifiable information. See the product list below. See the product list below. Web what is a 4506 t? Taxpayers can request a transcript of their entire tax. Request may be rejected if the form is incomplete or illegible. This form is used when people want to receive a tax return transcript, tax return, or other tax records. See the product list below. Do not sign this form unless all applicable lines have been completed. Covid eidl disaster request for transcript of tax return. Web what is a 4506 t? This form is used when people want to receive a tax return transcript, tax return, or other tax records. Web what is a 4506 t? Request for transcript of tax return. Do not sign this form unless all applicable lines have been completed. People can also use this form to request that. Web do not sign this form unless all applicable lines have been completed. This form is used when people want to receive a tax return transcript, tax return, or other tax records. See the product list below. Do not sign this form unless all applicable lines have been completed. See the product list below. Taxpayers can request a transcript of their entire tax. Disaster request for transcript of tax return. Covid eidl disaster request for transcript of tax return. Do not sign this form unless all applicable lines have been completed. This form gives permission for the irs to provide sba your tax return information when applying for covid eidl disaster loan assistance. Request for transcript of tax return. The transcript format better protects taxpayer data by partially masking personally identifiable information. See the product list below. Request may be rejected if the form is incomplete or illegible. Disaster request for transcript of tax return. Covid eidl disaster request for transcript of tax return. About this document and download. See the product list below. See the product list below. Taxpayers can request a transcript of their entire tax. Do not sign this form unless all applicable lines have been completed. See the product list below. Taxpayers can request a transcript of their entire tax. Web what is a 4506 t? Request may be rejected if the form is incomplete or illegible. The blank also requires the taxpayer to give the information about the type of tax return transcript that they are requesting. Do not sign this form unless all applicable lines have been completed. Request may be rejected if the form is incomplete or illegible. This form gives permission for the irs to provide sba your tax return information when applying for covid eidl disaster loan assistance. Disaster request for transcript of tax return. Covid eidl disaster request for transcript of tax. See the product list below. Request may be rejected if the form is incomplete or illegible. You can expect to receive a return transcript for the tax year 2018 at the address provided in the telephone request within 5 to 10 days from the time of the request. Covid eidl disaster request for transcript of tax return. Request for transcript. Request may be rejected if the form is incomplete or illegible. The blank also requires the taxpayer to give the information about the type of tax return transcript that they are requesting. You can expect to receive a return transcript for the tax year 2018 at the address provided in the telephone request within 5 to 10 days from the. Request may be rejected if the form is incomplete or illegible. This form gives permission for the irs to provide sba your tax return information when applying for covid eidl disaster loan assistance. About this document and download. Request may be rejected if the form is incomplete or illegible. See the product list below. Do not sign this form unless all applicable lines have been completed. Web do not sign this form unless all applicable lines have been completed. You can expect to receive a return transcript for the tax year 2018 at the address provided in the telephone request within 5 to 10 days from the time of the request. Do not sign this form unless all applicable lines have been completed. Request may be rejected if the form is incomplete or illegible. This form is used when people want to receive a tax return transcript, tax return, or other tax records. The blank also requires the taxpayer to give the information about the type of tax return transcript that they are requesting. See the product list below. Web what is a 4506 t? Request for transcript of tax return. People can also use this form to request that. The transcript format better protects taxpayer data by partially masking personally identifiable information. Taxpayers can request a transcript of their entire tax. See the product list below. Covid eidl disaster request for transcript of tax return. Request for transcript of tax return. People can also use this form to request that. The transcript format better protects taxpayer data by partially masking personally identifiable information. Covid eidl disaster request for transcript of tax return. See the product list below. This form gives permission for the irs to provide sba your tax return information when applying for covid eidl disaster loan assistance. See the product list below. Taxpayers can request a transcript of their entire tax. Request may be rejected if the form is incomplete or illegible. Web do not sign this form unless all applicable lines have been completed. This form is used when people want to receive a tax return transcript, tax return, or other tax records. Do not sign this form unless all applicable lines have been completed. Request may be rejected if the form is incomplete or illegible. Disaster request for transcript of tax return. See the product list below. About this document and download.Form 4506T Form Request For Transcript Of Tax Return printable pdf

4506T Request for Transcript of Tax Return

Download IRS Form 4506t for Free FormTemplate

4506T Form Tax Return (United States) Irs Tax Forms

Form 4506T Request for Transcript of Tax Return (2015) Free Download

IRS Form 4506T Download Fillable PDF or Fill Online Request for

Fillable Form 4506T Request For Transcript Of Tax Return printable

4506t fillable 2017 Fill out & sign online DocHub

2011 4506 T Fill Out and Sign Printable PDF Template signNow

4506 t Fill Online, Printable, Fillable Blank

Request May Be Rejected If The Form Is Incomplete Or Illegible.

Do Not Sign This Form Unless All Applicable Lines Have Been Completed.

You Can Expect To Receive A Return Transcript For The Tax Year 2018 At The Address Provided In The Telephone Request Within 5 To 10 Days From The Time Of The Request.

The Blank Also Requires The Taxpayer To Give The Information About The Type Of Tax Return Transcript That They Are Requesting.

Related Post: