Mo 1040A Printable Form

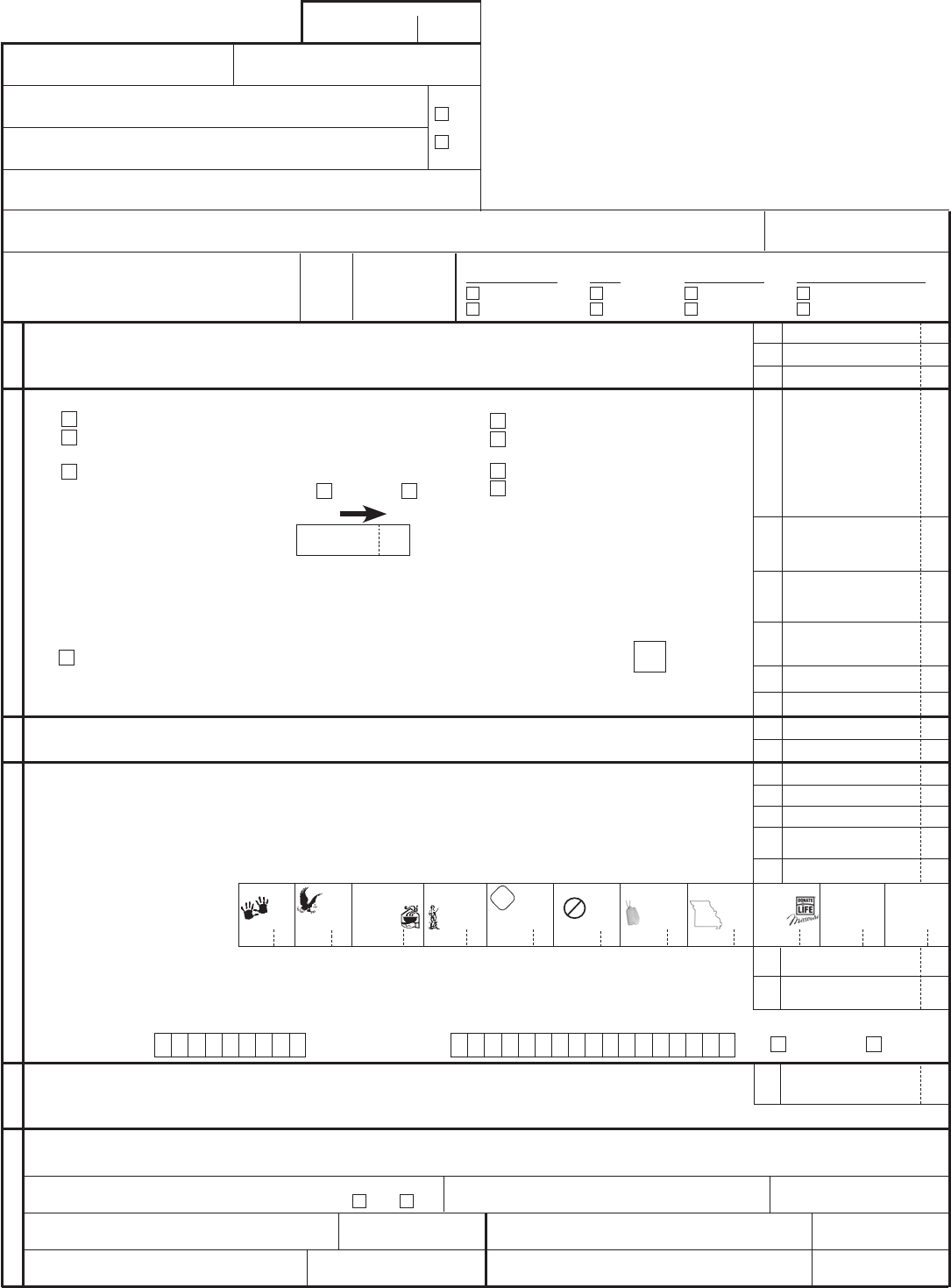

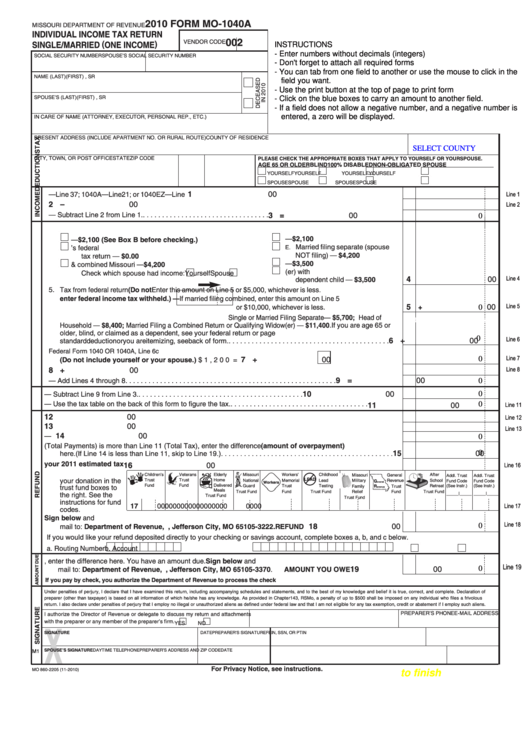

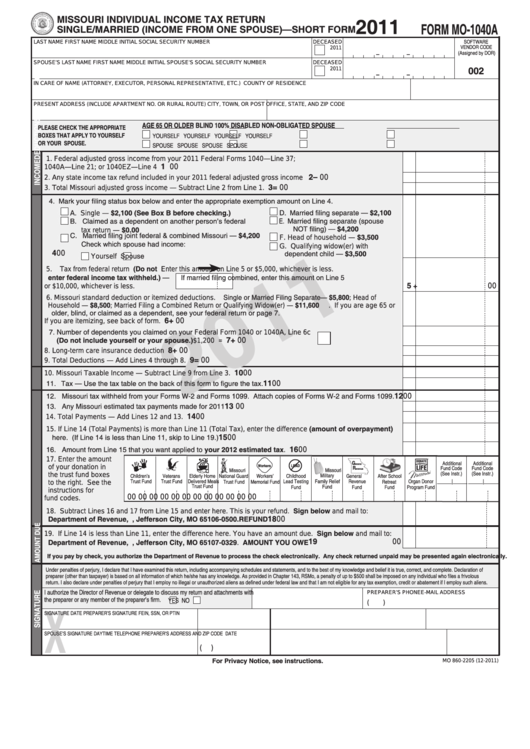

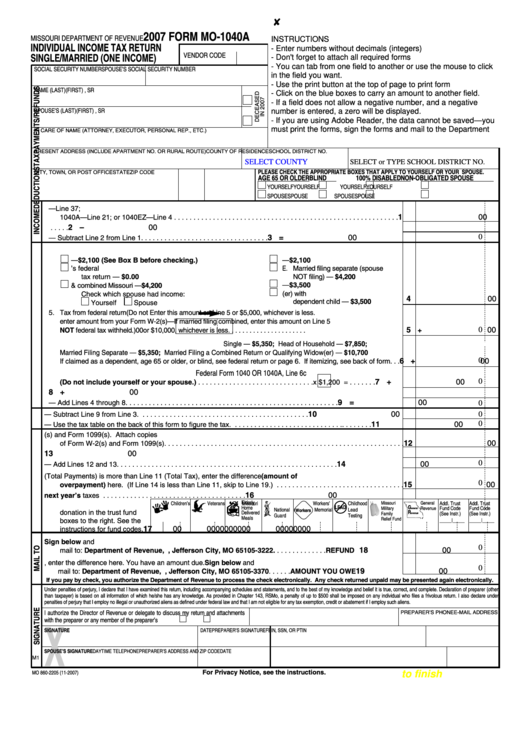

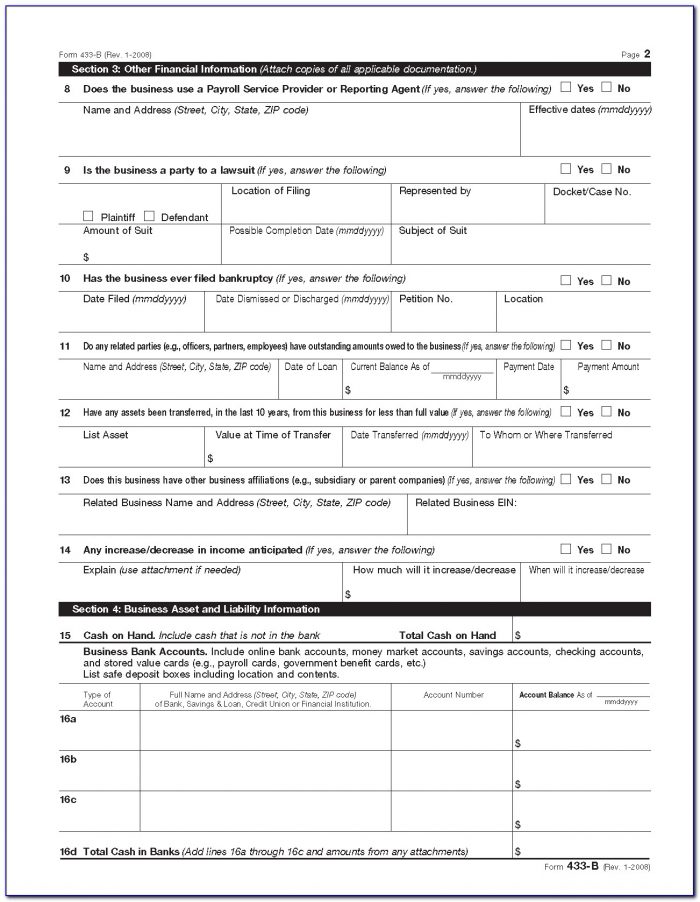

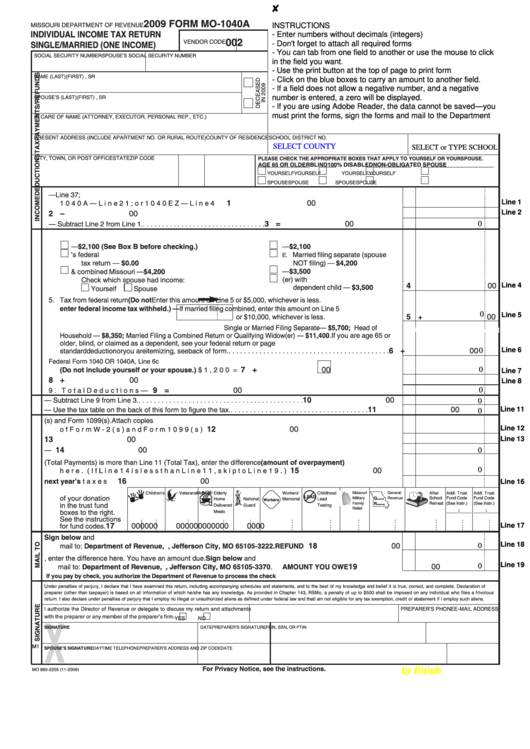

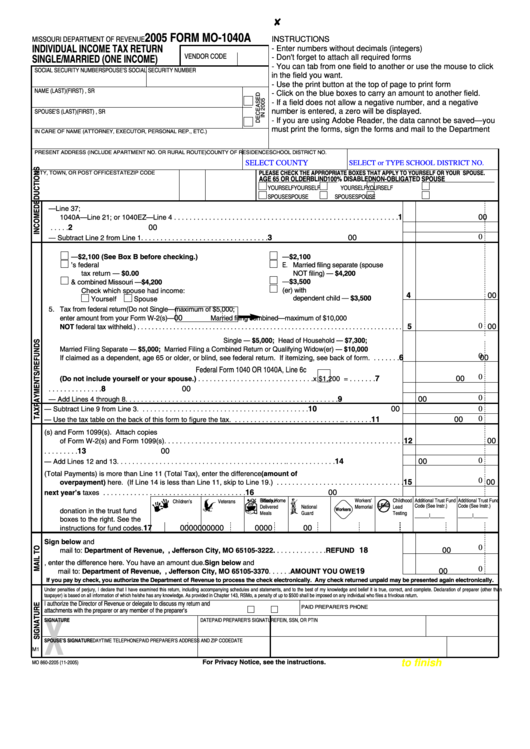

Mo 1040A Printable Form - Download and print the pdf file. Select what kind of esignature to generate. Don’t forget to enter your tax amount on line 28. Fill out the blank areas; Make your esignature and click on ok. This form is for income earned in tax year 2022, with tax returns due in april 2023. In care of name (attorney, executor, personal representative, etc.) attach form if applicable. Enter all required information in the required fillable fields. Find the form you would like to sign and click on upload. An uploaded, drawn or typed esignature. You claim certain tax credits; The missouri income tax rate for tax year 2022 is progressive from a low of 1.5% to. An uploaded, drawn or typed esignature. Printable missouri state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web form 1040a may be best for you. You can print other missouri tax forms here. You have capital gain distributions. You will find 3 options; Web form 1040a may be best for you if: Don’t forget to enter your tax amount on line 28. Select what kind of esignature to generate. Web find and fill out the correct 2016 missouri tax. Find the form you would like to sign and click on upload. Fill out the blank areas; Select the web sample from the library. Choose the correct version of the editable pdf form from the list and get started filling it out. You claim adjustments to income for ira contributions and student loan interest. For more information about the missouri income tax, see the missouri income tax page. Enter all required information in the required fillable fields. Your taxable income is less than $100,000. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. You can print other missouri tax forms here. You claim adjustments to income for ira contributions and student loan interest. An uploaded, drawn or typed esignature. Web free printable 2022 1040a form and 2022 1040a. Change the blanks with unique fillable fields. You will find 3 options; Web free printable 2022 1040a form and 2022 1040a instructions booklet sourced from the irs. Select the web sample from the library. Web find and fill out the correct 2016 missouri tax. For more information about the missouri income tax, see the missouri income tax page. Printable missouri state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Find the form you would like to sign and click on upload. Modifications on lines 1, 2, 3, 4 and 5 include. Web form 1040a may be best for you if: For privacy notice, see instructions. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. Modifications on lines 1, 2, 3, 4 and 5 include income that is exempt from federal tax, but taxable for state. You claim certain tax credits; Web find and fill out the correct 2016 missouri tax. You will find 3 options; The missouri income tax rate for tax year 2022 is progressive from a low of 1.5% to. Involved parties names, places of residence and phone numbers etc. Involved parties names, places of residence and phone numbers etc. For privacy notice, see instructions. Web find and fill out the correct 2016 missouri tax. Extension and attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. Select the web sample from the library. You can print other missouri tax forms here. Extension and attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. An uploaded, drawn or typed esignature. This form is for income earned in tax year 2022, with tax returns due in april 2023. For more information about the missouri income tax, see the missouri income tax page. You claim certain tax credits; Select what kind of esignature to generate. Web form 1040a may be best for you if: Put the date and place your electronic signature. In care of name (attorney, executor, personal representative, etc.) attach form if applicable. Fill out the blank areas; Make your esignature and click on ok. For privacy notice, see instructions. Select the web sample from the library. Involved parties names, places of residence and phone numbers etc. Don’t forget to enter your tax amount on line 28. The missouri income tax rate for tax year 2022 is progressive from a low of 1.5% to. County of residence present address (include apartment number or rural route) city, town, or post office last name in. You will find 3 options; Your taxable income is less than $100,000. Web free printable 2022 1040a form and 2022 1040a instructions booklet sourced from the irs. Find the form you would like to sign and click on upload. This form is for income earned in tax year 2022, with tax returns due in april 2023. You claim certain tax credits; Select the web sample from the library. You can print other missouri tax forms here. Printable missouri state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. You have capital gain distributions. Extension and attach a copy of your federal extension (federal form 4868) with your missouri income tax return when you file. Web print in black ink only and do not staple. Don’t forget to enter your tax amount on line 28. Put the date and place your electronic signature. Open it up using the online editor and begin altering. Make your esignature and click on ok. An uploaded, drawn or typed esignature. Web print this form it appears you don't have a pdf plugin for this browser.Form Mo1040A Missouri Department Of Revenue Edit, Fill, Sign

Fillable Form M01040a Individual Tax Return Single/married

2014 Mo 1040a Form Universal Network

Form Mo1040a Missouri Individual Tax Return Single/married

Fillable Form Mo1040a Individual Tax Return Single/married

Irs Fillable Form 1040a MBM Legal

Fillable Form Mo1040a Individual Tax Return Single/married

MO MO1040A 2012 Fill out Tax Template Online US Legal Forms

Fillable Form Mo1040a Missouri Individual Tax Return Single

1040a Short Form 2019 Form Resume Examples Mj1vNEaj1w

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Missouri Government.

Web 2022 Individual Income Tax Return.

Enter All Required Information In The Required Fillable Fields.

Web Form 1040A May Be Best For You If:

Related Post: