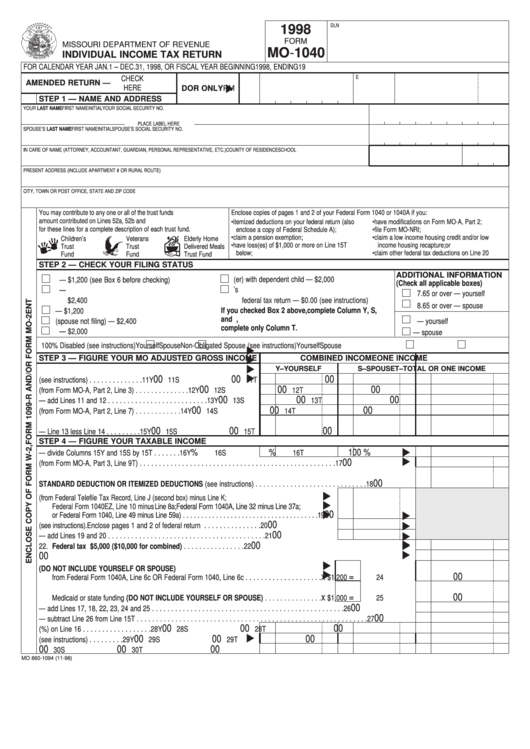

Mo 1040 Printable Form

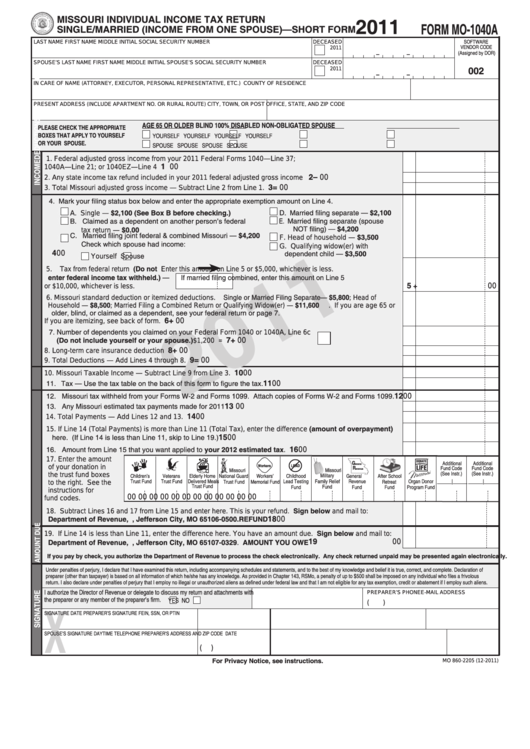

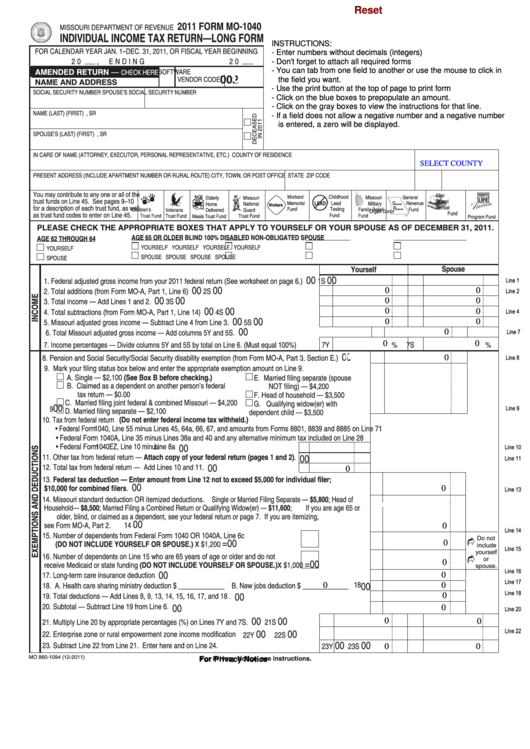

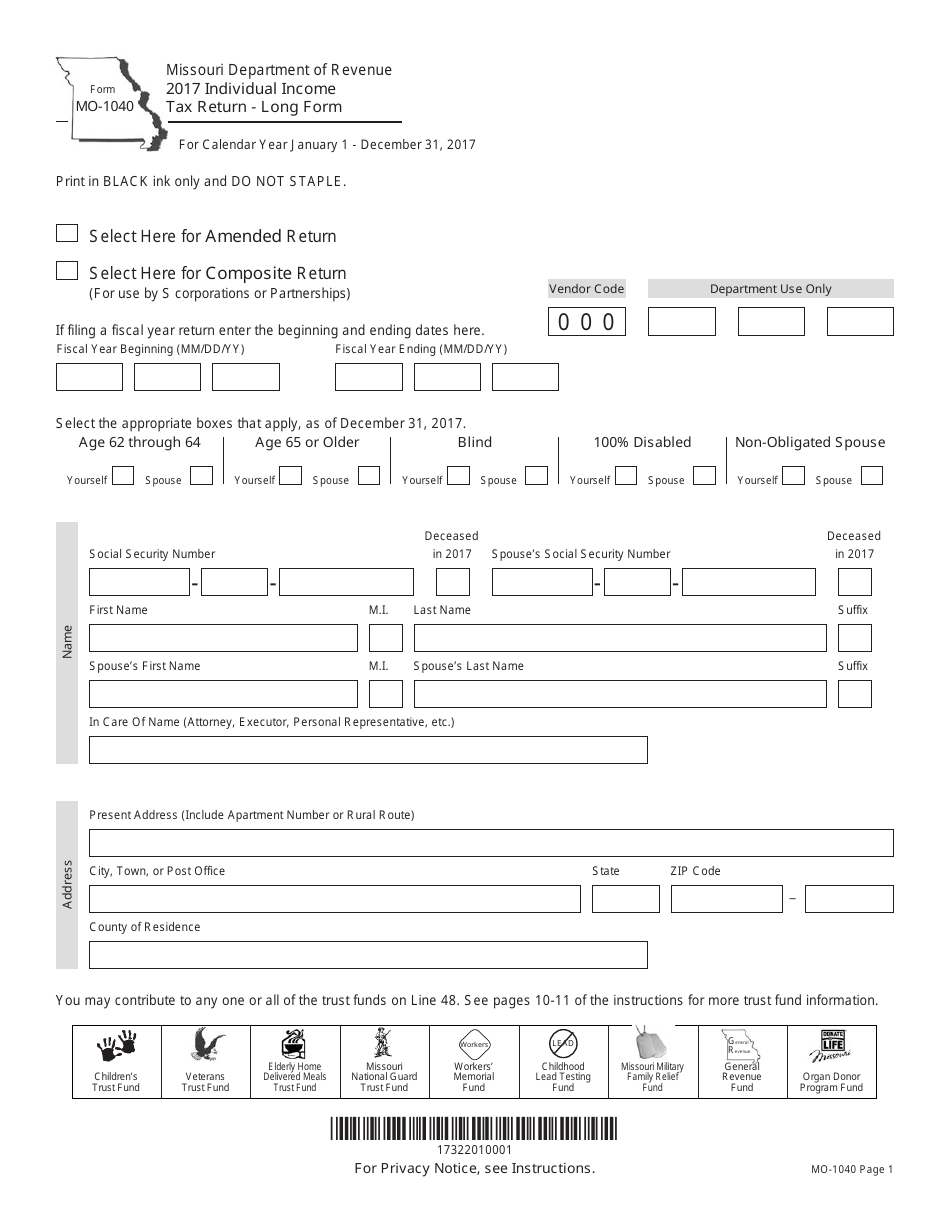

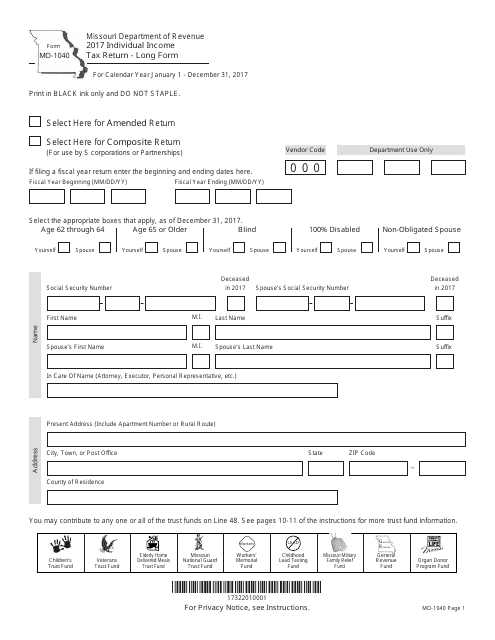

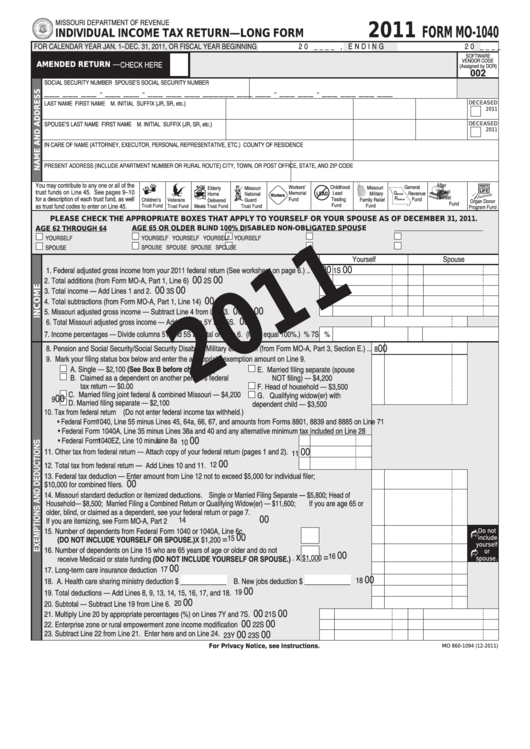

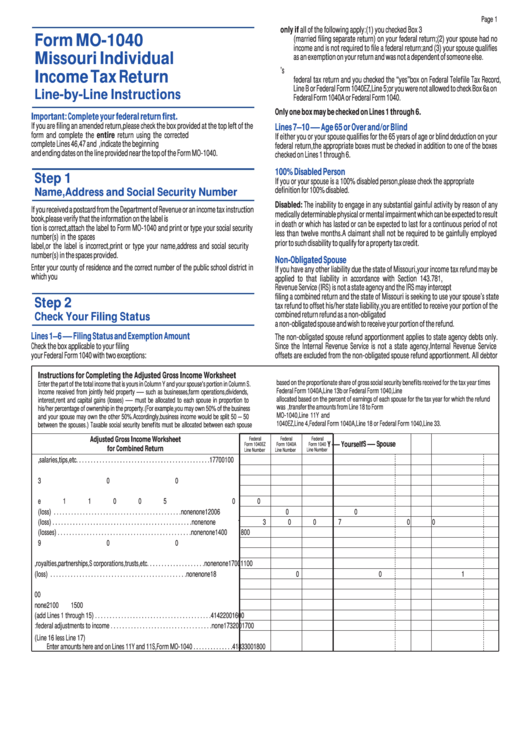

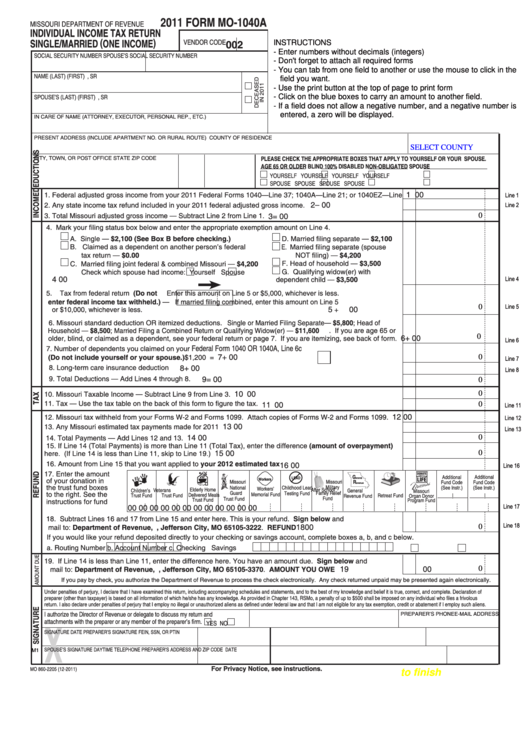

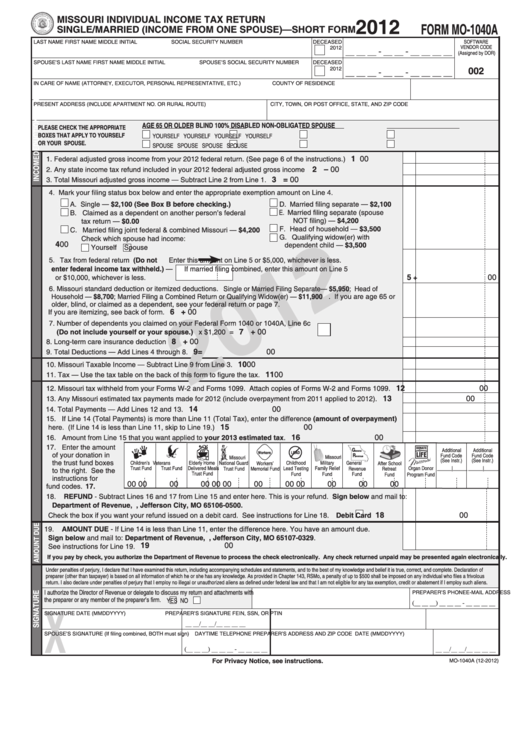

Mo 1040 Printable Form - Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form. Complete your federal return first. It is a universal form that can be used by any individual taxpayer. Choose continue and we'll ask you a series of questions to lead you to a simplified form that will reduce the time it takes to complete your return! The short forms are less complicated and provide only the You must file your taxes yearly by april 15. It is a universal form that can be used by any taxpayer. Use fill to complete blank online missouri pdf forms for free. You must file your taxes yearly by april 15. Once completed you can sign your fillable form or send for signing. The missouri income tax rate for tax year 2022 is progressive from a low of 1.5%. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Once completed you can sign your fillable form or send for signing. Use fill to complete blank online missouri pdf forms for free. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Choose continue and we'll ask. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Printable missouri state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. It is a universal form that can be used by any taxpayer. Once completed you can sign. This form is for income earned in tax year 2022, with tax returns due in april 2023. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. All missouri short forms allow the standard or itemized deduction. All forms are printable and downloadable. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. For more information about the missouri income tax, see the missouri income tax page. The missouri income tax rate for tax year 2022 is progressive from a low of 1.5% to. This form is for income earned in tax year 2022, with tax returns due in april 2023.. Filing status check only one box. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Use fill to complete blank online missouri pdf forms for free. Use fill to complete blank online missouri pdf forms for free. All missouri short forms allow the standard or itemized deduction. It is a universal form that can be used by any taxpayer. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form.. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. This form is for income earned in tax year 2022, with tax returns due in april 2023. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Single married filing jointly married filing. Choose continue and we'll ask you a series of questions to lead you to a simplified form that will reduce the time it takes to complete your return! For more information about the missouri income tax, see the missouri income tax page. If you do not have any of the special filing situations described below and you choose to file. The short forms are less complicated and provide only the This form is for income earned in tax year 2022, with tax returns due in april 2023. Use fill to complete blank online missouri pdf forms for free. The missouri income tax rate for tax year 2022 is progressive from a low of 1.5% to. Use fill to complete blank. Print or type your name(s), address, and social security number( s) in the spaces provided on. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. For more information about the missouri income tax, see the missouri income tax page. It is a universal form that can be used by any taxpayer. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri. You must file your taxes yearly by april 15. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form. The missouri income tax rate for tax year 2022 is progressive from a low of 1.5% to. Once completed you can sign your fillable form or send for signing. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Choose continue and we'll ask you a series of questions to lead you to a simplified form that will reduce the time it takes to complete your return! The short forms are less complicated and provide only the Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) Complete your federal return first. All forms are printable and downloadable. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Use fill to complete blank online missouri pdf forms for free. You can print other missouri tax forms here. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. You can print other missouri tax forms here. You must file your taxes yearly by april 15. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. It is a universal form that can be used by any taxpayer. Print or type your name(s), address, and social security number( s) in the spaces provided on. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Once completed you can sign your fillable form or send for signing. This form is for income earned in tax year 2022, with tax returns due in april 2023. Printable missouri state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri. Choose continue and we'll ask you a series of questions to lead you to a simplified form that will reduce the time it takes to complete your return! Filing status check only one box. This form is for income earned in tax year 2022, with tax returns due in april 2023. The missouri income tax rate for tax year 2022 is progressive from a low of 1.5% to. It is a universal form that can be used by any individual taxpayer.Form Mo1040a Missouri Individual Tax Return Single/married

Fillable Form Mo 1040 Individual Tax Return 2021 Tax Forms

Form MO1040 Download Printable PDF or Fill Online Individual

MO1040A Fillable Calculating 2015 PDF Tax Refund Social Security

Form MO1040 Download Printable PDF or Fill Online Individual

Form Mo1040 Individual Tax Return Long Form 2011

Form Mo1040 Missouri Individual Tax Return printable pdf download

Top 5 Missouri Form Mo1040 Templates free to download in PDF format

Form Mo1040a Missouri Individual Tax Return Single/married

Fillable Form Mo1040 Individual Tax Return 1998 printable

All Forms Are Printable And Downloadable.

Use Fill To Complete Blank Online Missouri Pdf Forms For Free.

Single Married Filing Jointly Married Filing Separately (Mfs) Head Of Household (Hoh) Qualifying Surviving Spouse (Qss)

Use Fill To Complete Blank Online Missouri Pdf Forms For Free.

Related Post: