Lbo Model Excel Template

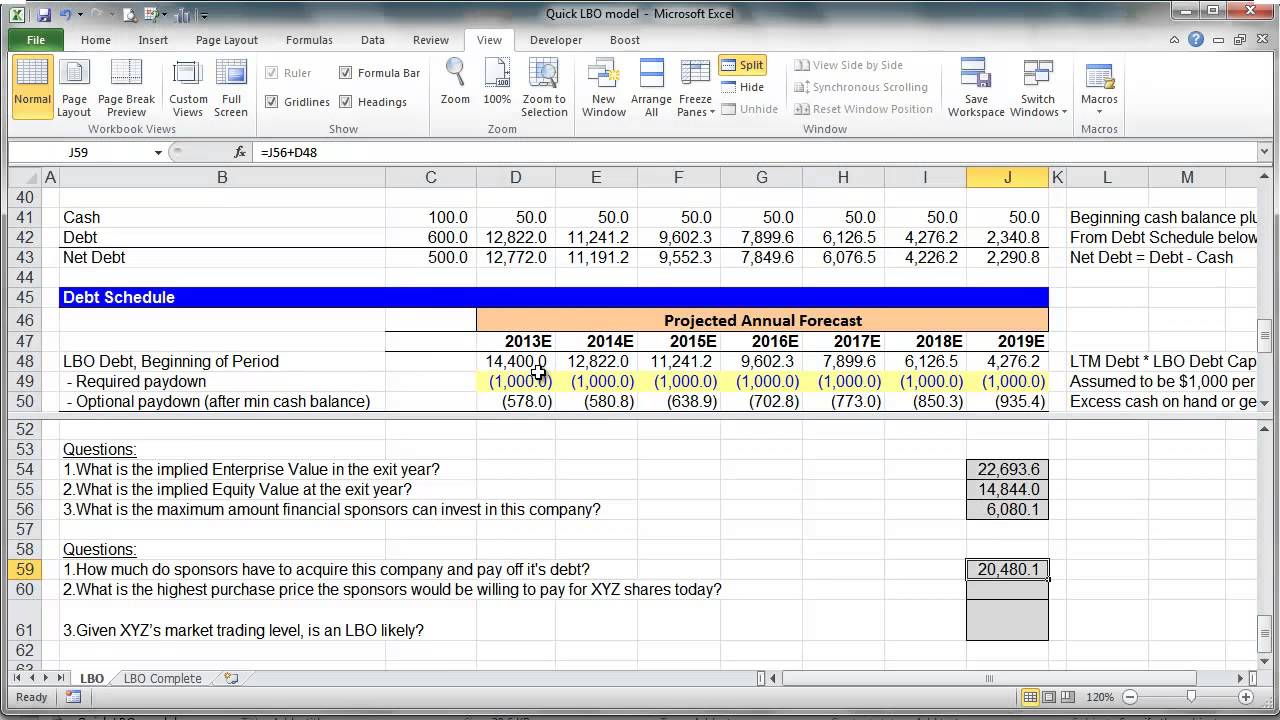

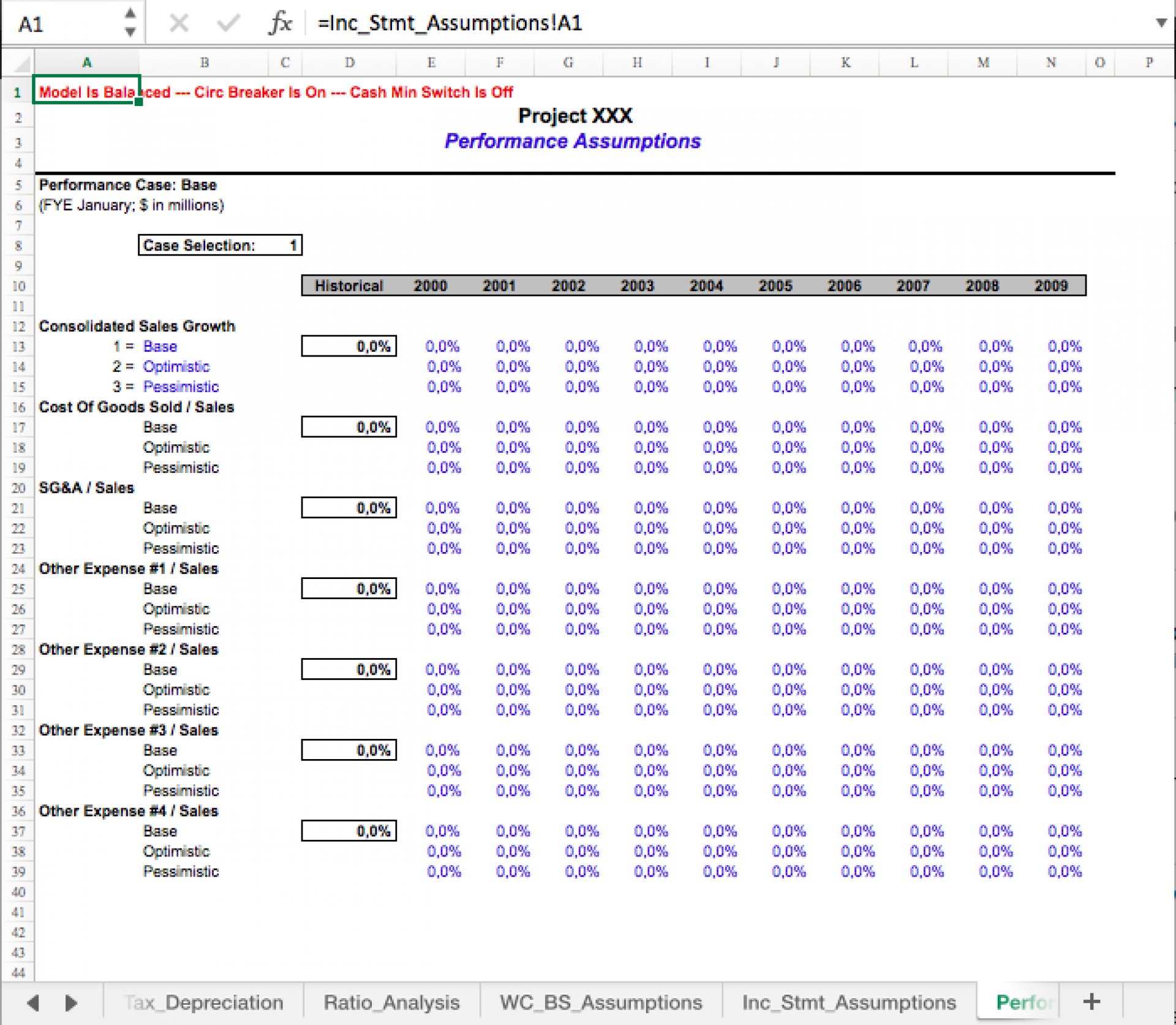

Lbo Model Excel Template - Therefore, we input an ebitda multiple assumption in this cell and work our way down to the implied offer value and offer value. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. In addition, will provide an empty version which allows you to input your own information. Another sample leverage buyout model template. Web download wso's free leveraged buyout (lbo) model template below! Web when you want to expand your business or launch a new venture, private equity firms can provide the funds you need to start. Web lbo model sample template. 1 = explicit ebitda multiple assumption when a private company undergoes an lbo, the valuation discussion is expressed in terms of a multiple of ebitda. Web a third method often employed in private equity valuations is the leveraged buyout (lbo) model. This technique assesses the potential return on investment for a leveraged buyout transaction by estimating the amount of debt financing required, projecting the company’s future cash flows, and determining the exit value at the end of the. This technique assesses the potential return on investment for a leveraged buyout transaction by estimating the amount of debt financing required, projecting the company’s future cash flows, and determining the exit value at the end of the. Web download wso's free leveraged buyout (lbo) model template below! Web lbo model sample template. Web when you want to expand your business. 1 = explicit ebitda multiple assumption when a private company undergoes an lbo, the valuation discussion is expressed in terms of a multiple of ebitda. Web lbo model sample template. Therefore, we input an ebitda multiple assumption in this cell and work our way down to the implied offer value and offer value. Web when you want to expand your. Web when you want to expand your business or launch a new venture, private equity firms can provide the funds you need to start. Web a third method often employed in private equity valuations is the leveraged buyout (lbo) model. Web lbo model sample template. Therefore, we input an ebitda multiple assumption in this cell and work our way down. This technique assesses the potential return on investment for a leveraged buyout transaction by estimating the amount of debt financing required, projecting the company’s future cash flows, and determining the exit value at the end of the. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Therefore, we input an ebitda. Web lbo model sample template. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. 1 = explicit ebitda multiple assumption when a private company undergoes an lbo, the valuation discussion is expressed in terms of a multiple of ebitda. In addition, will provide an empty version which allows you to input. In addition, will provide an empty version which allows you to input your own information. 1 = explicit ebitda multiple assumption when a private company undergoes an lbo, the valuation discussion is expressed in terms of a multiple of ebitda. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Web lbo. Another sample leverage buyout model template. 1 = explicit ebitda multiple assumption when a private company undergoes an lbo, the valuation discussion is expressed in terms of a multiple of ebitda. Web a third method often employed in private equity valuations is the leveraged buyout (lbo) model. In addition, will provide an empty version which allows you to input your. This technique assesses the potential return on investment for a leveraged buyout transaction by estimating the amount of debt financing required, projecting the company’s future cash flows, and determining the exit value at the end of the. Web download wso's free leveraged buyout (lbo) model template below! 1 = explicit ebitda multiple assumption when a private company undergoes an lbo,. 1 = explicit ebitda multiple assumption when a private company undergoes an lbo, the valuation discussion is expressed in terms of a multiple of ebitda. Web download wso's free leveraged buyout (lbo) model template below! This technique assesses the potential return on investment for a leveraged buyout transaction by estimating the amount of debt financing required, projecting the company’s future. Web when you want to expand your business or launch a new venture, private equity firms can provide the funds you need to start. Another sample leverage buyout model template. 1 = explicit ebitda multiple assumption when a private company undergoes an lbo, the valuation discussion is expressed in terms of a multiple of ebitda. Web lbo model sample template.. Web when you want to expand your business or launch a new venture, private equity firms can provide the funds you need to start. This technique assesses the potential return on investment for a leveraged buyout transaction by estimating the amount of debt financing required, projecting the company’s future cash flows, and determining the exit value at the end of the. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Web a third method often employed in private equity valuations is the leveraged buyout (lbo) model. Therefore, we input an ebitda multiple assumption in this cell and work our way down to the implied offer value and offer value. Web download wso's free leveraged buyout (lbo) model template below! Another sample leverage buyout model template. Web lbo model sample template. 1 = explicit ebitda multiple assumption when a private company undergoes an lbo, the valuation discussion is expressed in terms of a multiple of ebitda. In addition, will provide an empty version which allows you to input your own information. This technique assesses the potential return on investment for a leveraged buyout transaction by estimating the amount of debt financing required, projecting the company’s future cash flows, and determining the exit value at the end of the. Web when you want to expand your business or launch a new venture, private equity firms can provide the funds you need to start. 1 = explicit ebitda multiple assumption when a private company undergoes an lbo, the valuation discussion is expressed in terms of a multiple of ebitda. Therefore, we input an ebitda multiple assumption in this cell and work our way down to the implied offer value and offer value. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Web a third method often employed in private equity valuations is the leveraged buyout (lbo) model. Web lbo model sample template. Web download wso's free leveraged buyout (lbo) model template below!Detailed LBO Model Complete Private Equity Leveraged Buyout Analysis

Simple LBO Template Excel Model (Leveraged Buyout) Alexander Jarvis

Simple LBO Template Excel Model (Leveraged Buyout)

Detailed LBO Model Complete Private Equity Leveraged Buyout Analysis

Financial Modeling Quick Lesson Simple LBO Model (3 of 3) YouTube

LBO (Leveraged Buyout) Excel Model Template Professional Excel Model

Corporate Finance Institute

Leveraged Buyout (LBO) Model Template Excel Eloquens

LBO (Leveraged Buyout) Excel Model Template Professional Excel Model

LBO (Leveraged Buyout) Excel Model Template Professional Excel Model

Another Sample Leverage Buyout Model Template.

In Addition, Will Provide An Empty Version Which Allows You To Input Your Own Information.

Related Post: