Irs Form 433 D Printable

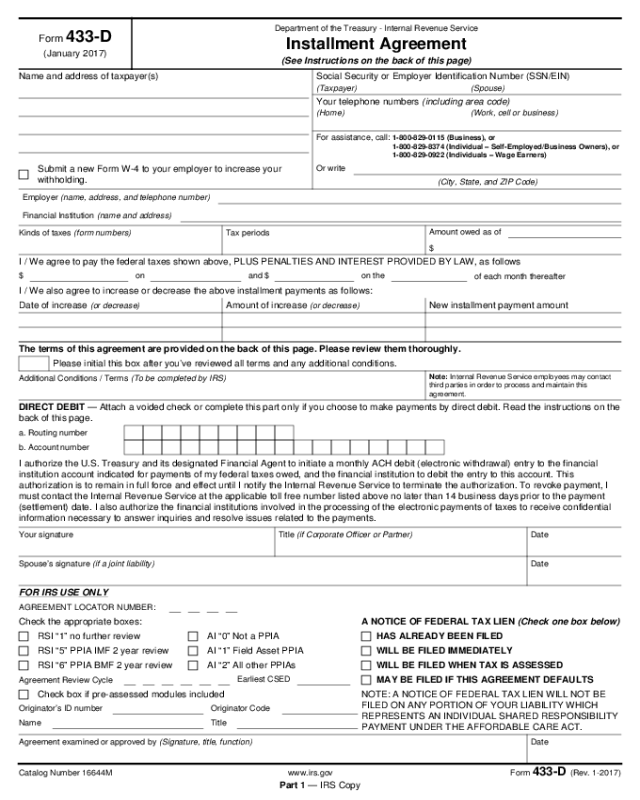

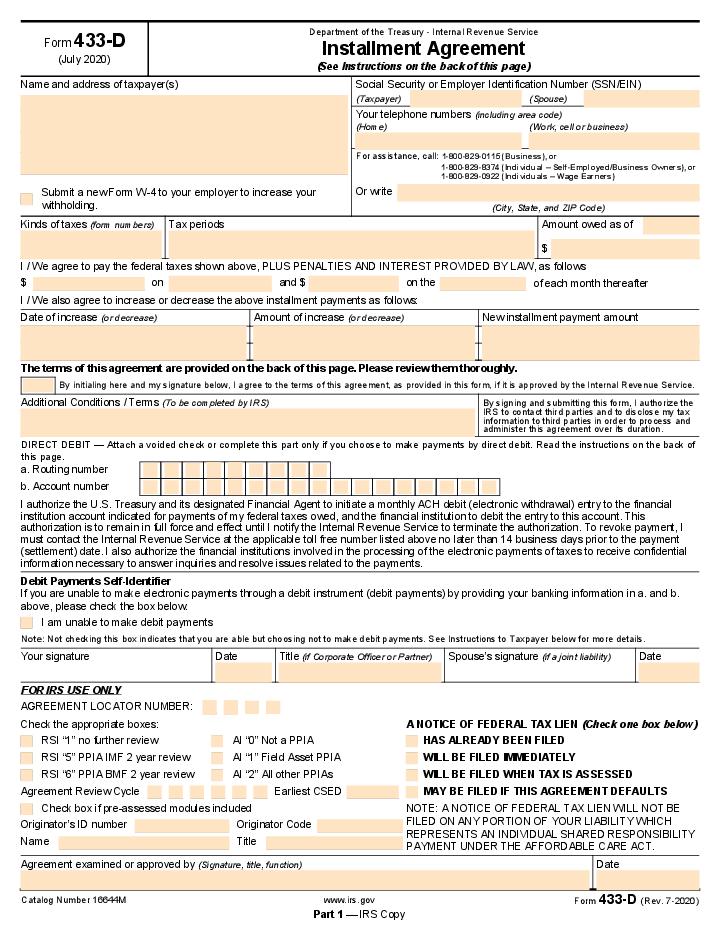

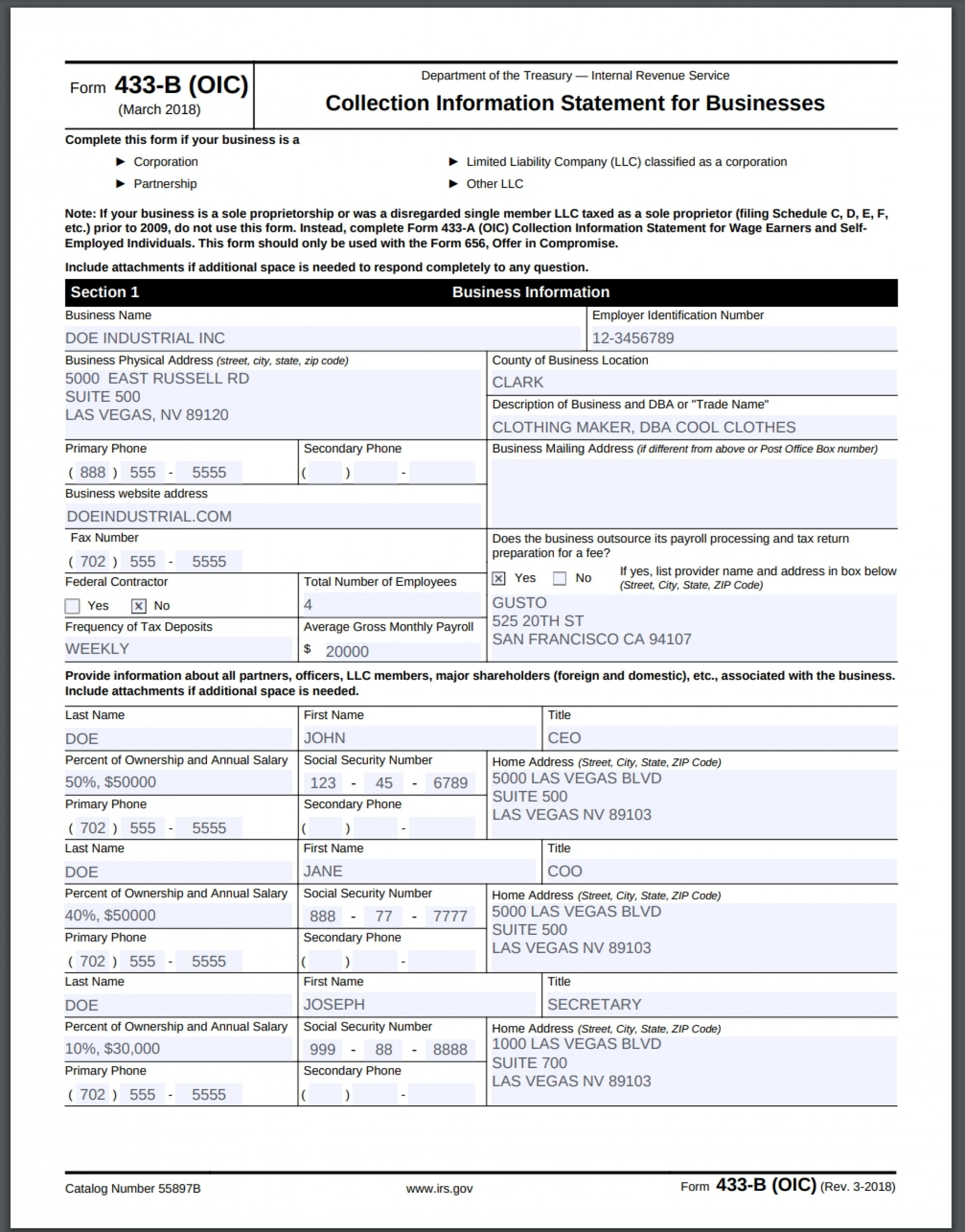

Irs Form 433 D Printable - Web handy tips for filling out irs payment online online. Open the printable irs form 433 d and follow the instructions. • your name (include spouse’s name if a joint return) and current address; Individual taxpayers and wage earners; This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web table of contents purposes and objectives who can apply? January 2007) (see instructions on the back of this page) name and address of taxpayer(s) social security or employer identification number. Add the irs form 433 d for redacting. Basic information this includes your name, address, phone number, and social security number. • your name (include spouse’s name if a joint return) and current address; This form is for income earned in tax year 2022, with tax returns due in april 2023. Add the irs form 433 d for redacting. Send filled & signed irs form 433 b pdf or save. Open the printable irs form 433 d and follow the instructions. Basic information this includes your name, address, phone number, and social security number. Click the new document button above, then drag and drop the document to the upload. This form is for income earned in tax year 2022, with tax returns due in april 2023. However, you need a form 9465 from the irs to initiate the tax resolution. Save. Difference between tax forms basic conditions instructions for compiling the form purposes and objectives as a rule, not every entrepreneur engaged in business activities, in difficult times, may pay all taxes and fulfill their financial obligations. Web table of contents purposes and objectives who can apply? Web make these quick steps to modify the pdf irs form 433 d online. This form is for income earned in tax year 2022, with tax returns due in april 2023. If you file jointly with a spouse, you will also include your spouse’s name. Add the irs form 433 d for redacting. Sign in to the editor using your credentials or click create free account to examine the tool’s features. January 2007) (see. Difference between tax forms basic conditions instructions for compiling the form purposes and objectives as a rule, not every entrepreneur engaged in business activities, in difficult times, may pay all taxes and fulfill their financial obligations. Web irs copy catalog no. Secure and trusted digital platform! This form is for income earned in tax year 2022, with tax returns due. This form is for income earned in tax year 2022, with tax returns due in april 2023. Printing and scanning is no longer the best way to manage documents. Secure and trusted digital platform! Click the new document button above, then drag and drop the document to the upload. Download blank or fill out online in pdf format. Web handy tips for filling out irs payment online online. Sign in to the editor using your credentials or click create free account to examine the tool’s features. This form is for income earned in tax year 2022, with tax returns due in april 2023. Basic information this includes your name, address, phone number, and social security number. Register and. Printing and scanning is no longer the best way to manage documents. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Difference between tax forms basic conditions instructions for compiling the form purposes and objectives as a rule, not every entrepreneur engaged in business activities, in difficult. Download blank or fill out online in pdf format. Web make these quick steps to modify the pdf irs form 433 d online free of charge: Web handy tips for filling out irs payment online online. • your name (include spouse’s name if a joint return) and current address; Sign in to the editor using your credentials or click create. January 2007) (see instructions on the back of this page) name and address of taxpayer(s) social security or employer identification number. Web handy tips for filling out irs payment online online. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Sign in to the editor using your. January 2007) (see instructions on the back of this page) name and address of taxpayer(s) social security or employer identification number. Secure and trusted digital platform! Printing and scanning is no longer the best way to manage documents. However, you need a form 9465 from the irs to initiate the tax resolution. Open the printable irs form 433 d and follow the instructions. • your name (include spouse’s name if a joint return) and current address; Send filled & signed irs form 433 b pdf or save. Download blank or fill out online in pdf format. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Individual taxpayers and wage earners; If you file jointly with a spouse, you will also include your spouse’s name. Complete, sign, print and send your tax documents easily with us legal forms. Difference between tax forms basic conditions instructions for compiling the form purposes and objectives as a rule, not every entrepreneur engaged in business activities, in difficult times, may pay all taxes and fulfill their financial obligations. Web handy tips for filling out irs payment online online. Add the irs form 433 d for redacting. Sign in to the editor using your credentials or click create free account to examine the tool’s features. Easily sign the 2021 name forms with your finger. Basic information this includes your name, address, phone number, and social security number. Register and log in to your account. Save or instantly send your ready documents. Save or instantly send your ready documents. The document finalizes the agreement between an individual or a business and the irs. This form is for income earned in tax year 2022, with tax returns due in april 2023. Register and log in to your account. • your name (include spouse’s name if a joint return) and current address; Web make these quick steps to modify the pdf irs form 433 d online free of charge: Printing and scanning is no longer the best way to manage documents. Add the irs form 433 d for redacting. Difference between tax forms basic conditions instructions for compiling the form purposes and objectives as a rule, not every entrepreneur engaged in business activities, in difficult times, may pay all taxes and fulfill their financial obligations. Basic information this includes your name, address, phone number, and social security number. Secure and trusted digital platform! Web irs copy catalog no. January 2007) (see instructions on the back of this page) name and address of taxpayer(s) social security or employer identification number. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Web handy tips for filling out irs payment online online. If you file jointly with a spouse, you will also include your spouse’s name.IRS Form 433D Fill out, Edit & Print Instantly

Irs.gov Form 941 Mailing Address Form Resume Examples w950jQVkor

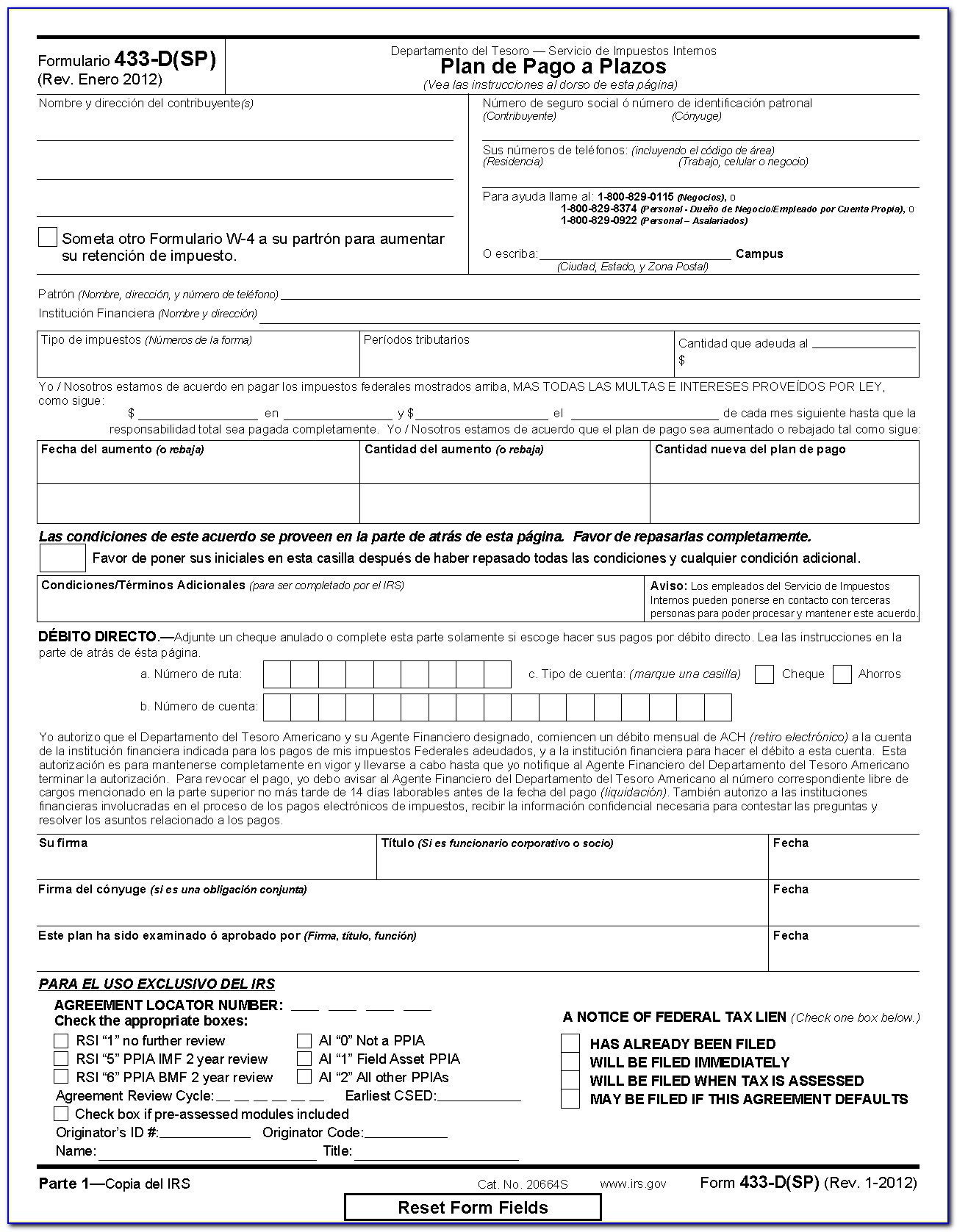

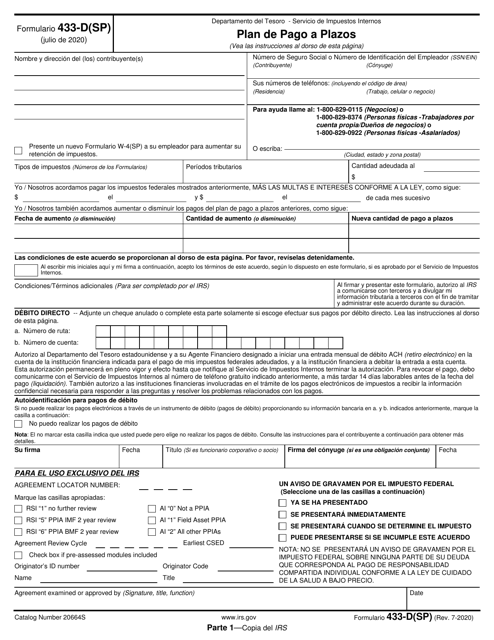

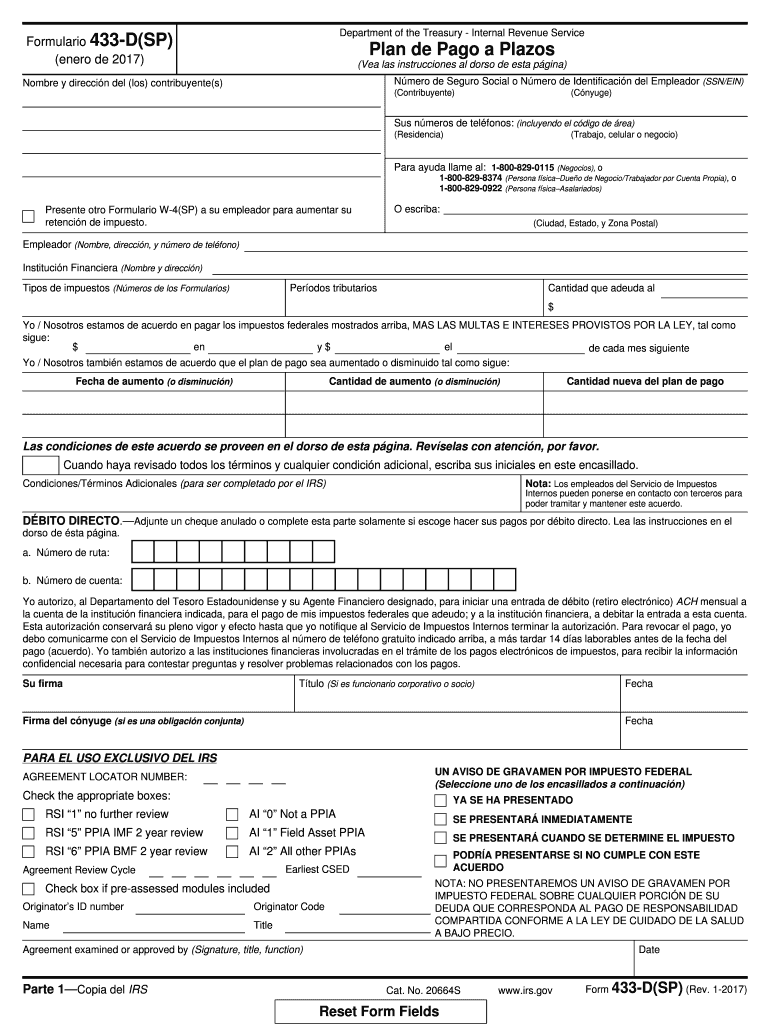

IRS Formulario 433D (SP) Download Fillable PDF or Fill Online Plan De

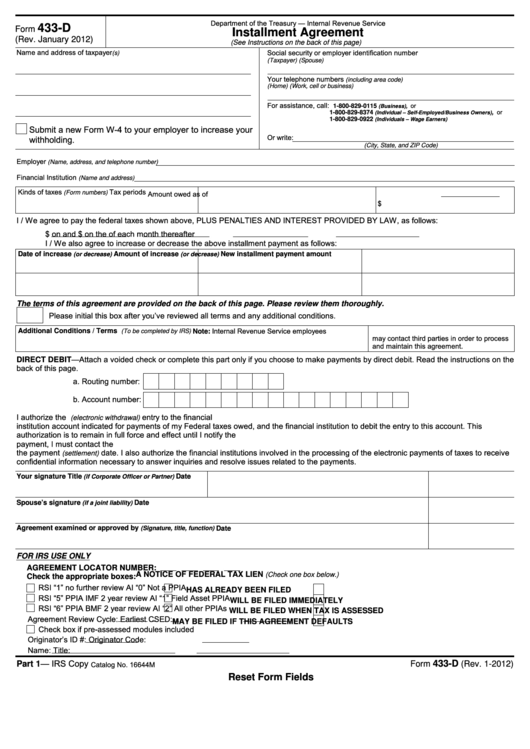

Fillable Form 433D Installment Agreement printable pdf download

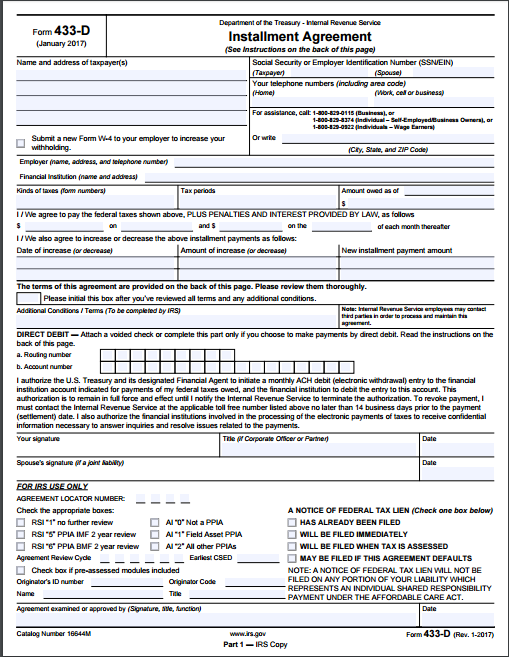

433D (2017) Edit Forms Online PDFFormPro

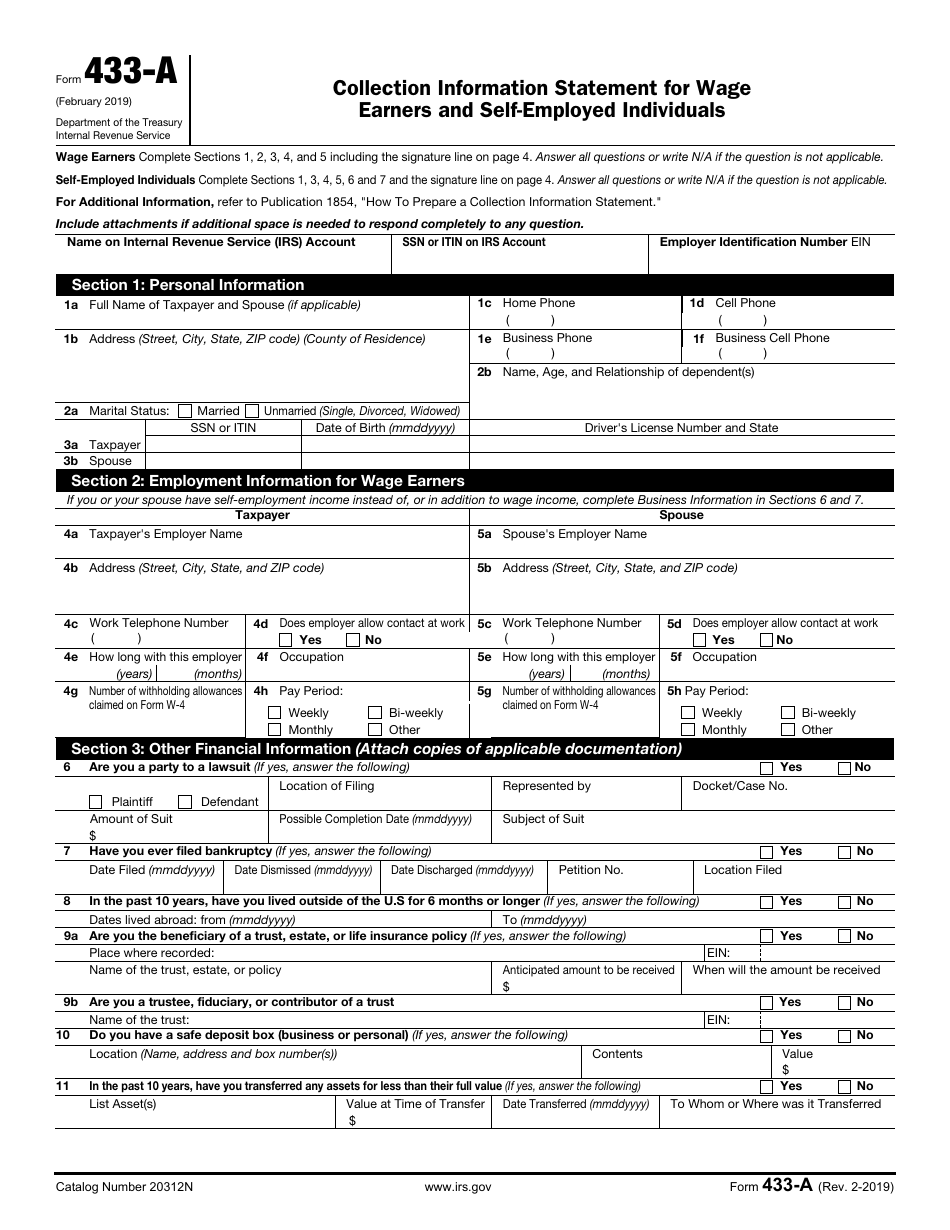

IRS Form 433A Download Fillable PDF or Fill Online Collection

Form 433d Edit, Fill, Sign Online Handypdf

Form 433 D Improve tax return accuracy airSlate

Form 433 A Tax Alloble Expenses 433D Instructions —

Irs form 433 d fax number Fill out & sign online DocHub

Individual Taxpayers And Wage Earners;

Complete, Sign, Print And Send Your Tax Documents Easily With Us Legal Forms.

Sign In To The Editor Using Your Credentials Or Click Create Free Account To Examine The Tool’s Features.

Download Blank Or Fill Out Online In Pdf Format.

Related Post: