Irs Form 147C Printable

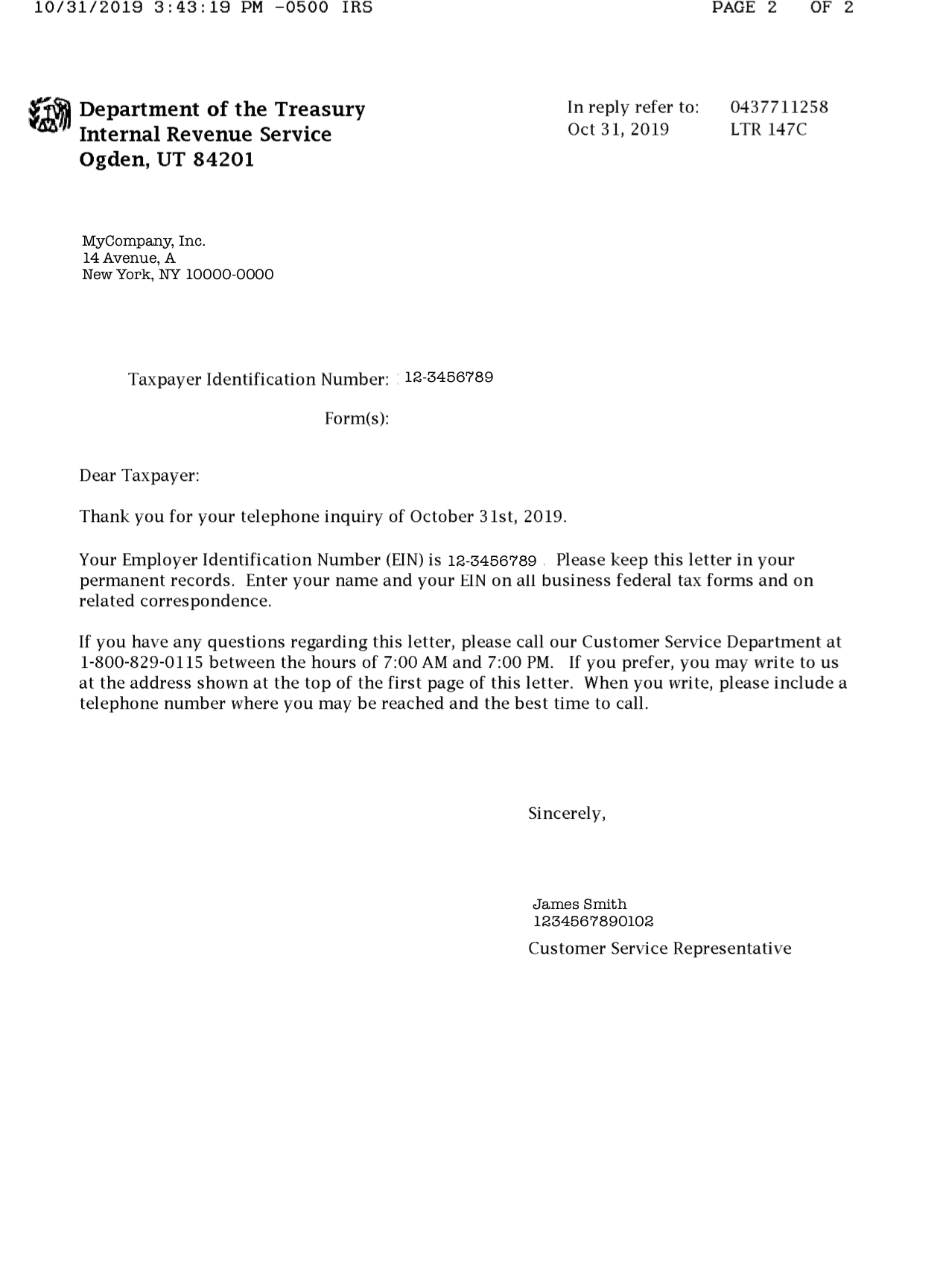

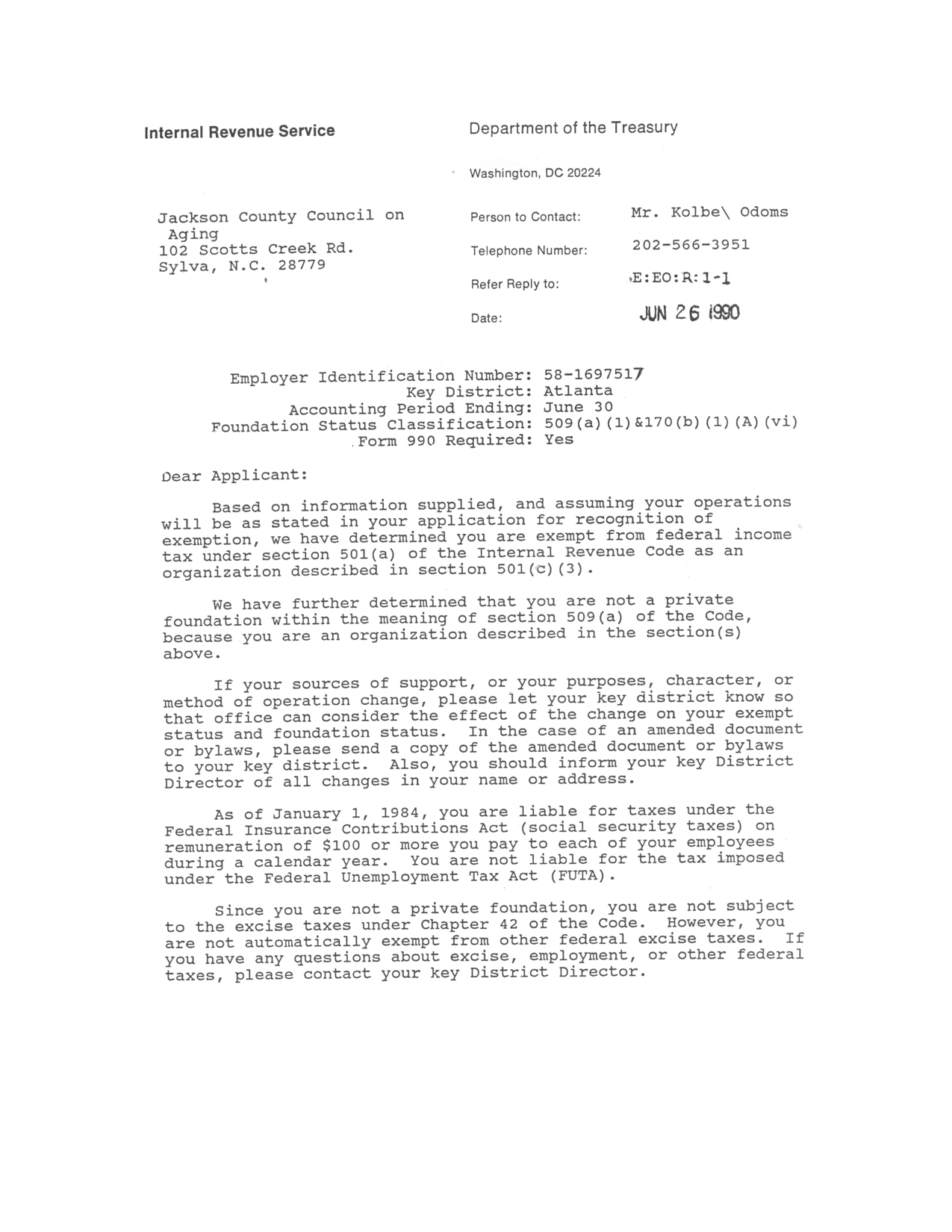

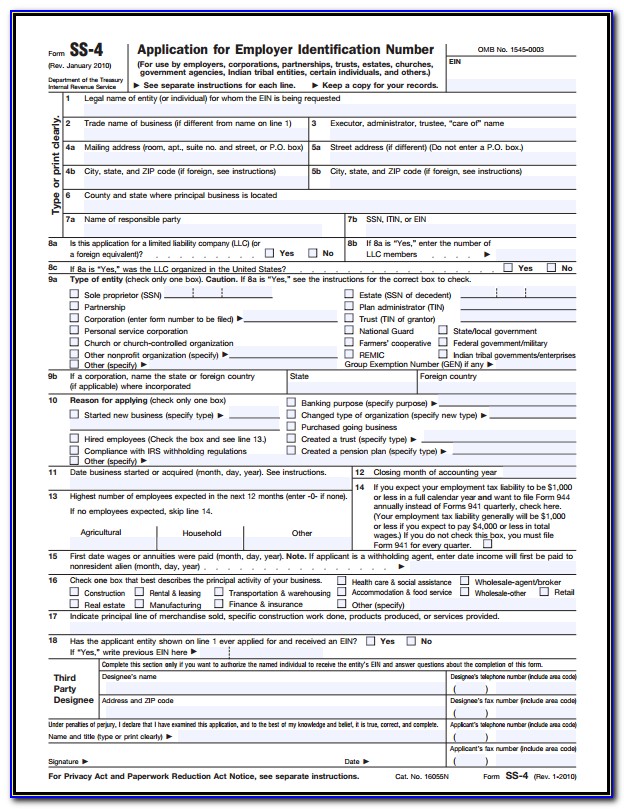

Irs Form 147C Printable - Make sure that your poa is prepared to. Instead, this is a form that will be. Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification. Form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Your previously filed return should. Web there is a solution if you don’t have possession of the ein confirmation letter. Easily fill out pdf blank, edit, and sign them. Start completing the fillable fields. Web open form follow the instructions easily sign the form with your finger send filled & signed form or save form 147c pdf rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8. Decide on what kind of esignature. You’ll be able to confirm this address when you’re on the phone with the irs agent. Web complete printable 147c form online with us legal forms. Web there is a solution if you don’t have possession of the ein confirmation letter. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal. You’ll be able to confirm this address when you’re on the phone with the irs agent. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Use get form or simply click on the template preview to open it in the editor. Web there. Decide on what kind of esignature. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein. Web edit form 147c pdf. Easily fill out pdf blank, edit, and sign them. Web if your clergy and/or employees are unable to. Web make sure that the words “147c letter” are written in the ‘tax form number’ field in section 3 of form 2848. Save or instantly send your ready documents. Web complete printable 147c form online with us legal forms. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have. Web if your clergy and/or employees are unable to e‐file their income tax returns because of a problem with your fein ore ein (federal employer identification number), you can. Start completing the fillable fields. Use get form or simply click on the template preview to open it in the editor. Web a 147c letter, also known as an ein verification. Web make sure that the words “147c letter” are written in the ‘tax form number’ field in section 3 of form 2848. Effortlessly add and underline text, insert pictures, checkmarks, and signs, drop new fillable areas, and rearrange or delete pages from your document. Your previously filed return should. The business can contact the irs directly and request a replacement. Select the document you want to sign and click upload. Instead, this is a form that will be. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Web open form follow the instructions easily sign the form with your finger. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Select the document you want to sign and click upload. This letter serves as a. The section looks like this: Effortlessly add and underline text, insert pictures, checkmarks, and signs, drop new fillable areas,. The irs will mail your 147c letter to the mailing address they have on file for your llc. Web make sure that the words “147c letter” are written in the ‘tax form number’ field in section 3 of form 2848. Web edit form 147c pdf. Web an ein verification letter ( commonly known as a form 147c) is an official. Make sure that your poa is prepared to. Web make sure that the words “147c letter” are written in the ‘tax form number’ field in section 3 of form 2848. Start completing the fillable fields. Decide on what kind of esignature. This letter serves as a. The irs will mail your 147c letter to the mailing address they have on file for your llc. Form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Select the document you want to sign and click upload. Your previously filed return should. You’ll be able to confirm this address when you’re on the phone with the irs agent. Web open form follow the instructions easily sign the form with your finger send filled & signed form or save form 147c pdf rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8. Web there is a solution if you don’t have possession of the ein confirmation letter. Save or instantly send your ready documents. Use get form or simply click on the template preview to open it in the editor. Web make sure that the words “147c letter” are written in the ‘tax form number’ field in section 3 of form 2848. Easily fill out pdf blank, edit, and sign them. Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification. Web complete printable 147c form online with us legal forms. Web edit form 147c pdf. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Make sure that your poa is prepared to. Effortlessly add and underline text, insert pictures, checkmarks, and signs, drop new fillable areas, and rearrange or delete pages from your document. The business can contact the irs directly and request a replacement confirmation letter called a 147c. This letter serves as a. Form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Instead, this is a form that will be. Web open form follow the instructions easily sign the form with your finger send filled & signed form or save form 147c pdf rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8. Web if your clergy and/or employees are unable to e‐file their income tax returns because of a problem with your fein ore ein (federal employer identification number), you can. The section looks like this: Effortlessly add and underline text, insert pictures, checkmarks, and signs, drop new fillable areas, and rearrange or delete pages from your document. Start completing the fillable fields. Use get form or simply click on the template preview to open it in the editor. This letter serves as a. Web edit form 147c pdf. Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification. Save or instantly send your ready documents. Your previously filed return should. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein. The irs will mail your 147c letter to the mailing address they have on file for your llc.How can I get a copy of my EIN Verification Letter (147C) from the IRS

gangster disciples litature irs form 147c

IRS FORM 147C PDF

Getting 147C Online (EIN Designation Confirmation Letter) 911 WeKnow

Irs Ein Form 147c Universal Network

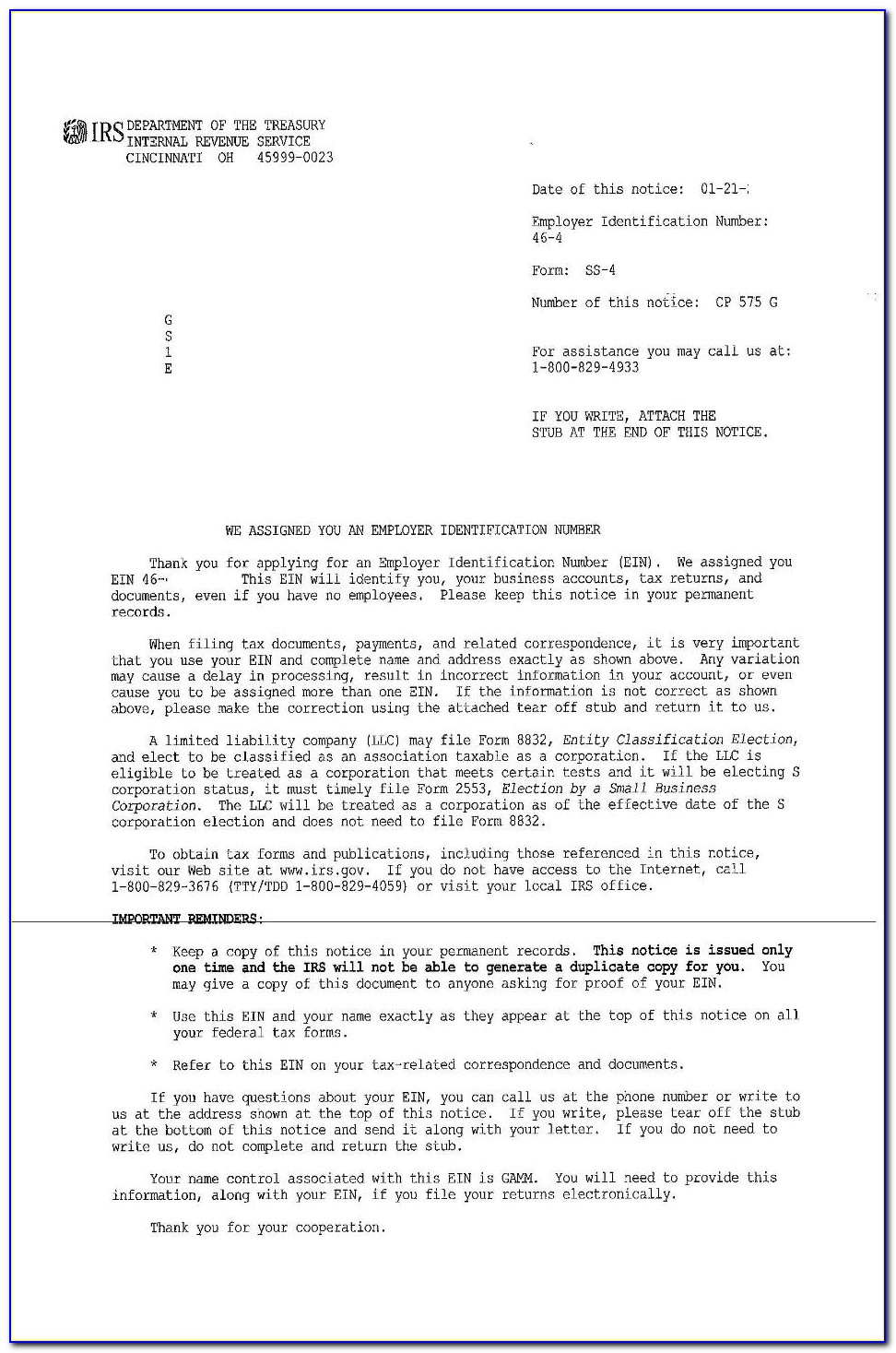

What Is Form CP575? Gusto

Irs Form 147c Letter Letter Resume Examples QBD3EAp2OX

Printable Fillable Printable 147c Form Master of Documents

Irs Form 147c Letter Letter Resume Examples QBD3EAp2OX

Irs Letter 147c Sample

You’ll Be Able To Confirm This Address When You’re On The Phone With The Irs Agent.

Web Make Sure That The Words “147C Letter” Are Written In The ‘Tax Form Number’ Field In Section 3 Of Form 2848.

Select The Document You Want To Sign And Click Upload.

The Business Can Contact The Irs Directly And Request A Replacement Confirmation Letter Called A 147C.

Related Post: