Free Printable Sales Tax Chart

Free Printable Sales Tax Chart - Round down, if less than $0.005. Sales tax chart generator % sales tax chart generator with subtotal + tax % Web sales and use tax sales and use tax rates & other information tax rates & charts tax rates & charts note: The 07011, clifton, new jersey, general sales tax rate is 6.625%. No states saw ranking changes of more than one place since july. Web there's nothing too taxing about our printable sales tax worksheets! Web free printable business form template: Calculate the tax to the third decimal place as follows: Sales tax rate decreased from 5.125% to 5% as of july 1, 2022. You can look up applicable sales tax rates in your area with our sales tax calculator. Calculate the tax to the third decimal point. Tax rate tables delivered via email monthly to keep you up to date on changing rates. Up to date, 2023 new jersey sales tax rates. No states saw ranking changes of more than one place since july. Web simply enter your state's sales and use tax rate in the form below, and. Web local tax rates in new jersey range from 0.00%, making the sales tax range in new jersey 6.63%. 7.0 7.2 7.3 7.4 7.5 7.6 7.7 7.8 7.9 8.0 8.1 8.2 8.3 8.4 8.5 8.53 8.6 8.7 8.78 8.8 8.9 9.0 9.08 9.1 9.2 9.3 9.4 9.5 9.6 9.8 9.9. You can fully customize this tax table for any sales. Web sales tax table. The 07011, clifton, new jersey, general sales tax rate is 6.625%. You can look up applicable sales tax rates in your area with our sales tax calculator. Countries that impose a vat can also impose it on imported and exported goods. Round the purchase price down to the closest row if the price is not in. Web free printable business form template: Web vat is the version of sales tax commonly used outside of the u.s. You can fully customize this tax table for any sales tax rate, price increment, or. The 07011, clifton, new jersey, general sales tax rate is 6.625%. The five states with the highest average local sales tax rates are alabama (5.22. New jersey sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. $20 (flowers) x 0.06625 (sales tax rate) = $1.325 Web free printable business form template: Price up to tax price up to tax price up to tax price up to tax price up to tax. Table of sales tax rates by state updated april 2023 state name state rate range of local rates avg. This sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. The state sales tax rate in texas. If you are looking for additional detail, you may wish to utilize the sales tax rate databases, which are provided in a comma separated value (csv) format. The tax amount is a mathematical computation of the sales price of the taxable property multiplied by the sales and use tax rate, rounded to the nearest whole cent. Web vat is the. Use our sales tax calculator or download a free new jersey sales tax rate table by zip code. The sales tax chart will popup in a new web browser window, and you can print it from there. 7.0 7.2 7.3 7.4 7.5 7.6 7.7 7.8 7.9 8.0 8.1 8.2 8.3 8.4 8.5 8.53 8.6 8.7 8.78 8.8 8.9 9.0 9.08. Sales tax rate decreased from 5.125% to 5% as of july 1, 2022. Countries that impose a vat can also impose it on imported and exported goods. A customer purchases flowers for $20. Table of sales tax rates by state updated april 2023 state name state rate range of local rates avg. Teeming with exercises like finding the sales tax,. You can fully customize this tax table for any sales tax rate, price increment, or. Web simply enter your state's sales and use tax rate in the form below, and click on the click here to generate sales tax chart button. Teeming with exercises like finding the sales tax, calculating the original price, and solving sales tax word problems, our. $20 (flowers) x 0.06625 (sales tax rate) = $1.325 Find your new jersey combined state and local tax rate. Web download sales tax rate tables for any state for free. A customer purchases flowers for $20. If you are looking for additional detail, you may wish to utilize the sales tax rate databases, which are provided in a comma separated value (csv) format. Web sales and use tax sales and use tax rates & other information tax rates & charts tax rates & charts note: Table of sales tax rates by state updated april 2023 state name state rate range of local rates avg. This sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. You can look up applicable sales tax rates in your area with our sales tax calculator. Sales tax chart generator % sales tax chart generator with subtotal + tax % Calculate the tax to the third decimal place as follows: Calculate the tax to the third decimal point. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Web local tax rates in new jersey range from 0.00%, making the sales tax range in new jersey 6.63%. New mexico does not grant credit for sales tax paid to pennsylvania on motor vehicles. You can fully customize this tax table for any sales tax rate, price increment, or. Web sales tax table. The five states with the highest average local sales tax rates are alabama (5.22 percent), louisiana (5.07 percent), colorado (4.75 percent), new york (4.52 percent), and oklahoma (4.45 percent). The 07011, clifton, new jersey, general sales tax rate is 6.625%. Round the purchase price down to the closest row if the price is not in the table. Up to date, 2023 new jersey sales tax rates. Web local tax rates in new jersey range from 0.00%, making the sales tax range in new jersey 6.63%. Web sales tax table. Sales tax chart generator % sales tax chart generator with subtotal + tax % Find your new jersey combined state and local tax rate. Up to date, 2023 new jersey sales tax rates. The state sales tax rate in texas is 6.25%, but you can customize this table as needed to. Web sales and use tax sales and use tax rates & other information tax rates & charts tax rates & charts note: You can fully customize this tax table for any sales tax rate, price increment, or. Calculate the tax to the third decimal point. New jersey sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. Web if you are not using the tax bracket, you must: To use this chart, locate the row that contains the purchase price. No states saw ranking changes of more than one place since july. Web vat is the version of sales tax commonly used outside of the u.s. Web free printable business form template:sales tax chart 8.25 Google Search Sales tax, Market day ideas

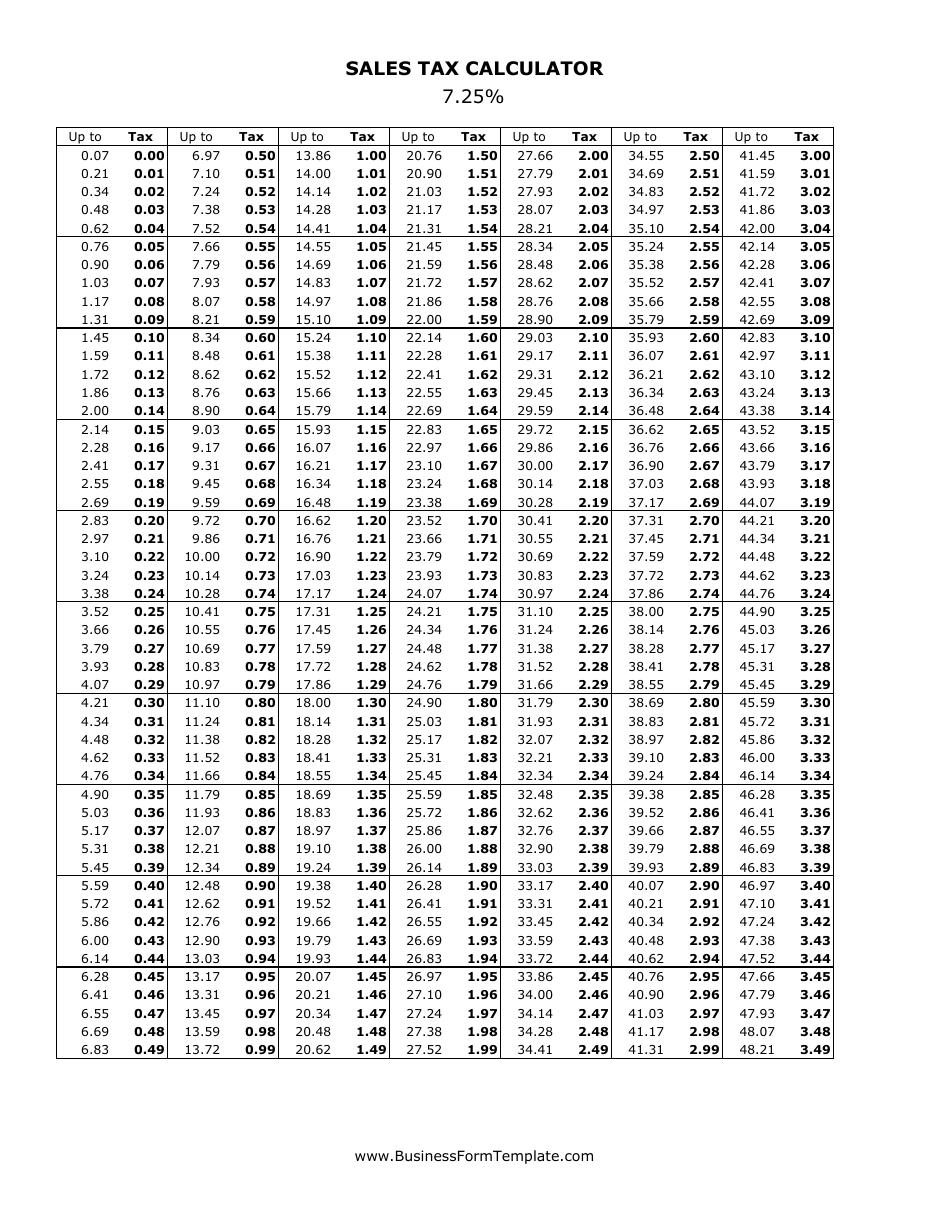

7.25 Sales Tax Calculator Download Printable PDF Templateroller

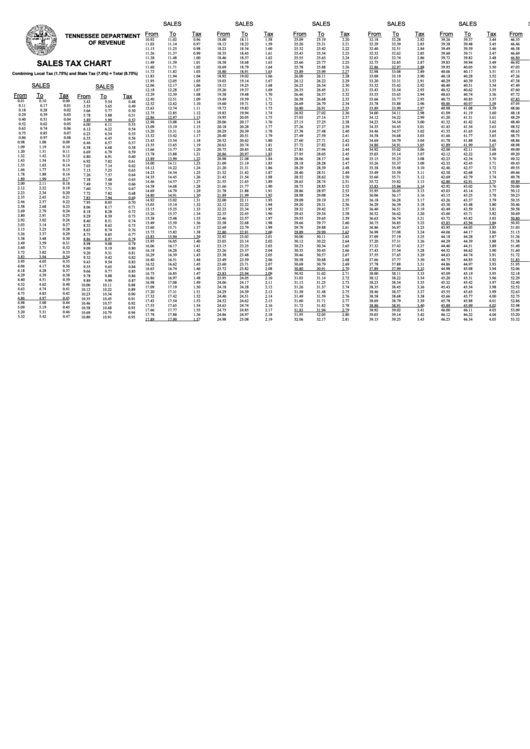

Sales And Use Tax Chart 8.75 Tennessee Department Of Revenue

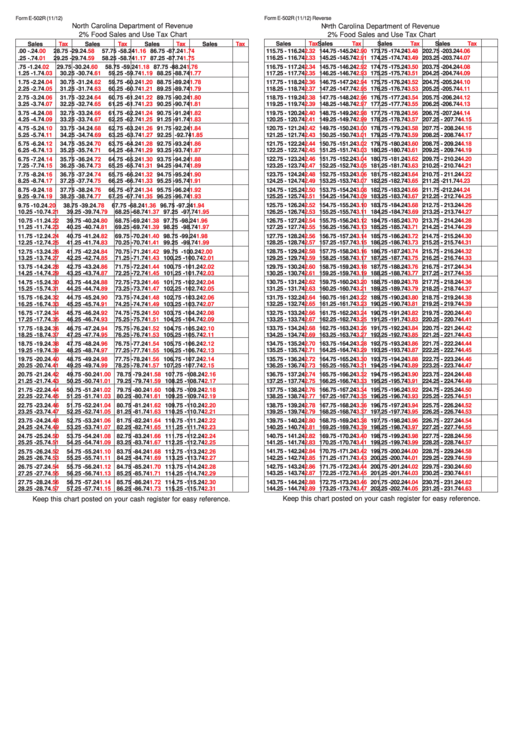

Form E502r 2 Food Sales And Use Tax Chart printable pdf download

Printable 6 Sales Tax Table Tax table, Sales tax, Life skills class

Lost Dollars, Empty Plates 2012 California Food Policy Advocates

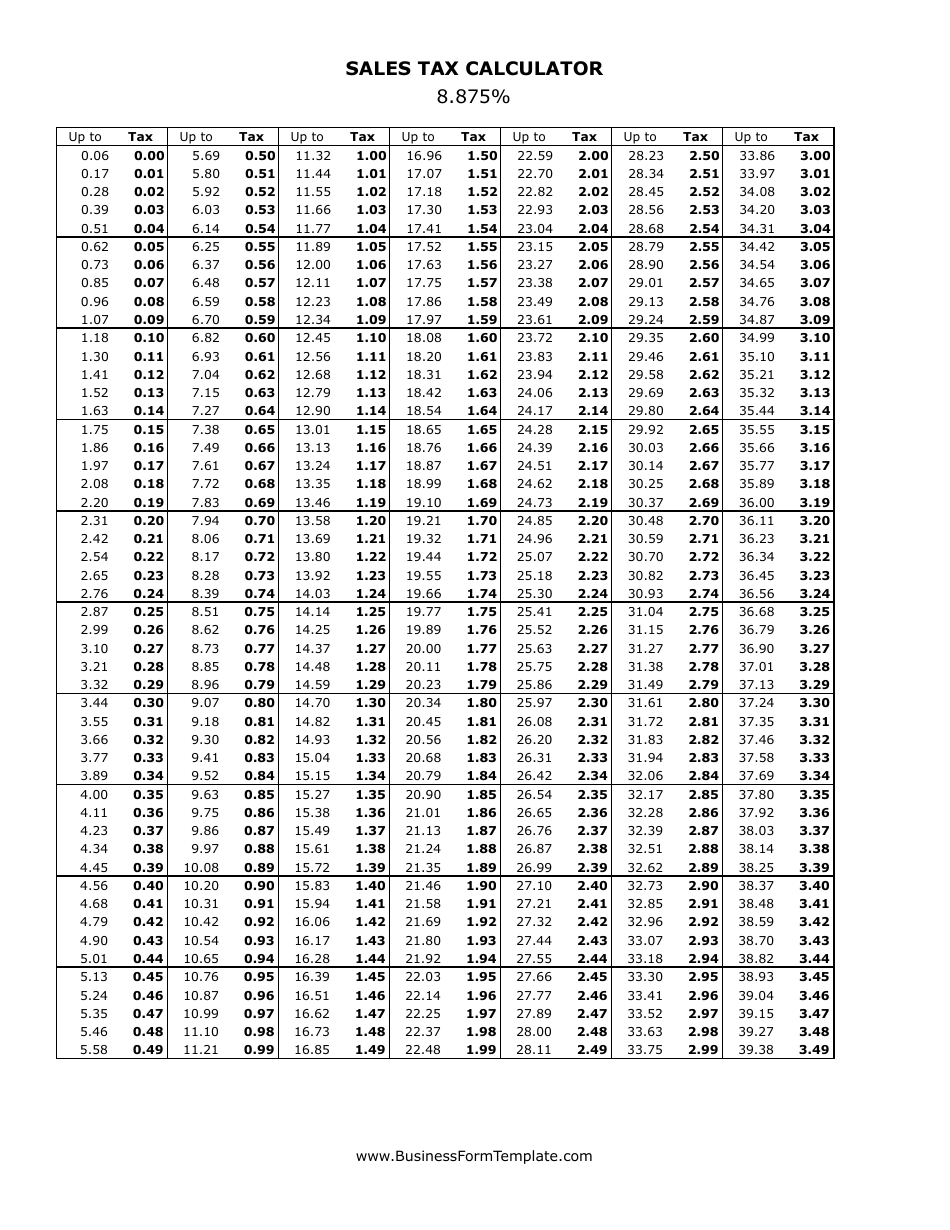

8.875 Sales Tax Calculator Download Printable PDF Templateroller

Local Sales Tax Collection Table 0715

Sales Tax Spreadsheet Within Sales Tax Spreadsheet Templates

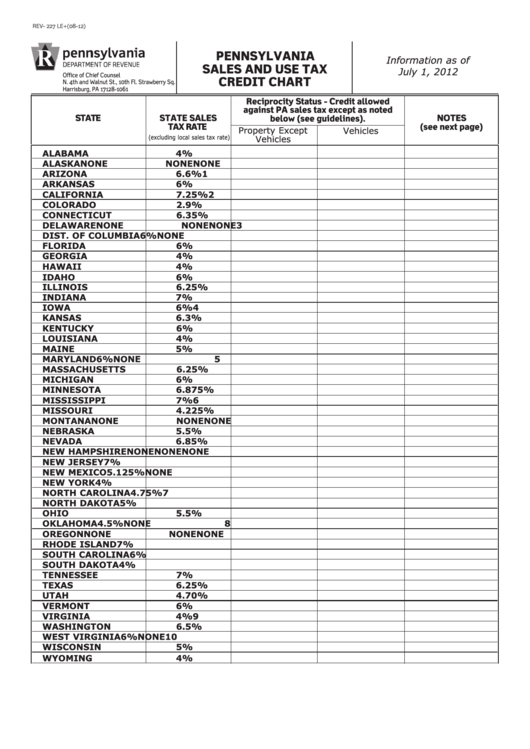

Pennsylvania Sales And Use Tax Credit Chart 2012 printable pdf download

Countries That Impose A Vat Can Also Impose It On Imported And Exported Goods.

Price Up To Tax Price Up To Tax Price Up To Tax Price Up To Tax Price Up To Tax Price Up To Tax Price Up To Tax;

Web Download Sales Tax Rate Tables For Any State For Free.

Web Simply Enter Your State's Sales And Use Tax Rate In The Form Below, And Click On The Click Here To Generate Sales Tax Chart Button.

Related Post: