Debt Snowball Printable

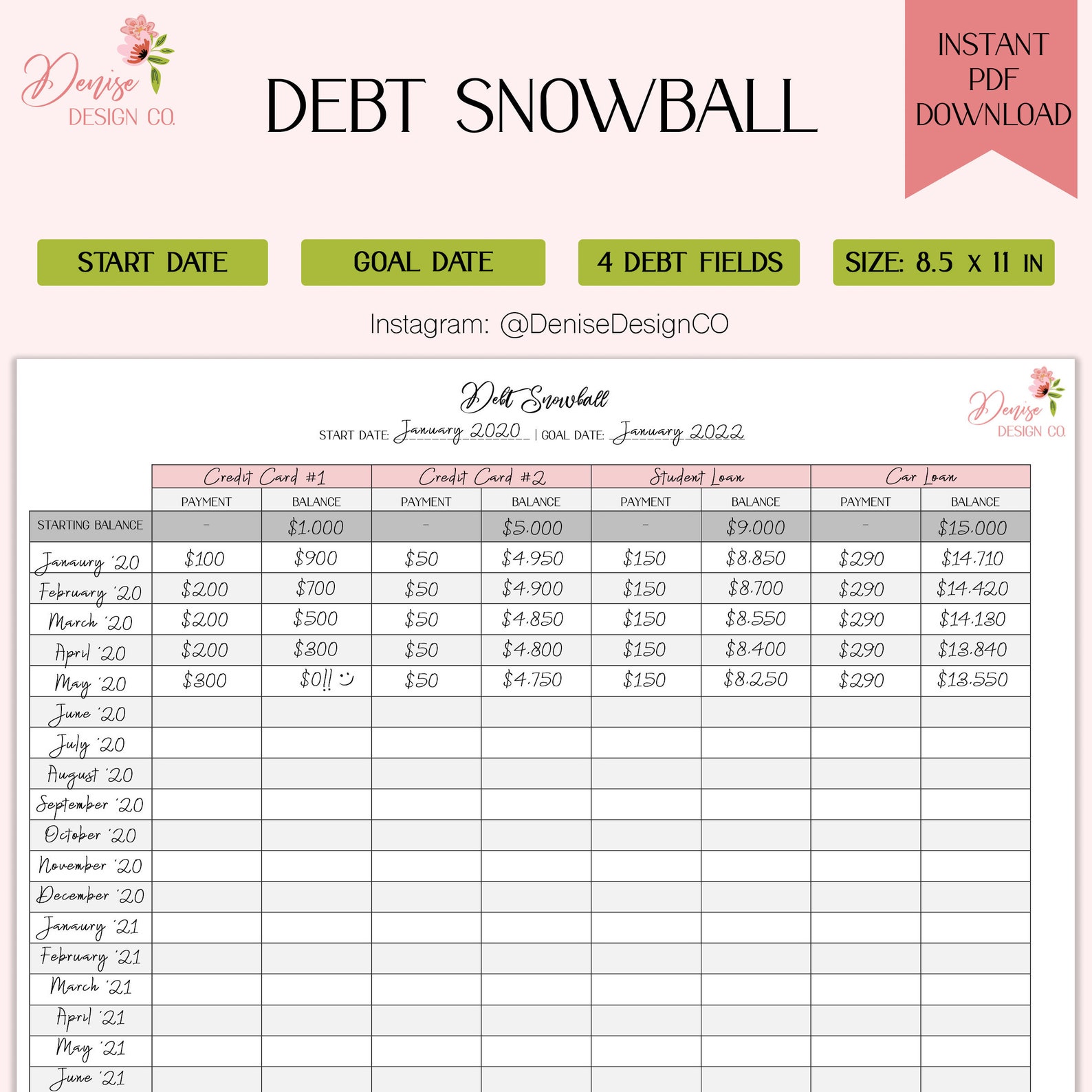

Debt Snowball Printable - Whether you take out a loan, pay off a mortgage, or spend a certain amount of money on a credit card, your primary goal is a debt payoff. Do the same for the second smallest debt untill that one is paid off as well. We have lots of budget printables available in our shop and for free to help you on your debt free journey. The smallest debt will be the one that will be getting the snowball payment. $1,500 balance, $25 minimum payment, 15% interest rate. Debt snowball spreadsheet in google docs/excel; Let’s say an individual has the following debts: You’ll use the former to make your plan. There are tons of ways to pay off debt, but i would argue that this method is the most successful. If you prefer to use a spreadsheet to track your debt payoff progress,you can grab my debt payoff toolkit here. Web debt snowball spreadsheet instructions 1. We now understand how the snowball method works and benefits us, and we have looked into various other ways we can reduce debt. Pay the minimum payment on every debt except the sma llest. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff. Pay as much as you can towards the smallest debt while making minimum payments on everything else. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. Web check out our debt snowball printable selection for the very best in unique or custom, handmade pieces from our calendars & planners shops. $2,000 balance,. In order to do this, you will need a debt snowball worksheet and a debt snowball calculator. Web use this debt snowball worksheet to stay organized and track the progress of your own debt payment. Web debt snowball illustration & free printable debt payoff worksheet pdf. Web below are 10 debt snowball worksheets that you can download for free to. Web track your monthly payments and debt payoff progress with these free debt snowball printable worksheets. Download save money (and trees!) go digital with your budget. Write each one of your debts down on this form in order from smallest to largest. This worksheet makes it easy to pay off debt quickly with the debt snowball method. Pay the minimum. Then you need the latter to come up with the amount and time you’ll need to complete your debts. Track your monthly payments and debt payoff progress with this free debt snowball printable. We can finally dive into how you can create your own debt payoff spreadsheet. This is the exact debt snowball form that we used to get out. Web snowball worksheet debt list all your debts below starting from the smallest to the largest balance. Pay the minimum payment on every debt except the sma llest. Web the debt snowball involves tackling your debt from the smallest to the largest balance. Web to make it easier for you to start your debt snowball, i created a free printable. The debt snowball method is as simple as writing down all of your debt accounts from lowest to highest and starting small. Web the debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Web debt snowball illustration & free printable debt payoff worksheet. $2,000 balance, $35 minimum payment, 18% interest rate. Pay as much money as possible to the smallest debt. You’ll use the former to make your plan. Web track your monthly payments and debt payoff progress with these free debt snowball printable worksheets. The debt snowball method is as simple as writing down all of your debt accounts from lowest to. Then you need the latter to come up with the amount and time you’ll need to complete your debts. This process works, and you can see how effective it is on our printable guide. When you pay off the smallest debt, add that minimum payment amount to your next smallest debt payment. Put any extra dollar amount into your smallest. Web an example of the debt snowball. Download pro rata debt list form if you can't pay your debts in full each month, this form helps you calculate how much each creditor gets paid right now. .paying off debt doesn't have to be so hard. Available as printable pdf or google docs sheet. Fill out your debts from smallest to. Web to make it easier for you to start your debt snowball, i created a free printable debt snowball worksheet! In order to do this, you will need a debt snowball worksheet and a debt snowball calculator. $10,000 balance, $150 minimum payment,. Fill out your debts from smallest to largest. Once you’ve paid off your smallest debt, then you move up to the next smallest debt. The smallest debt will be the one that will be getting the snowball payment. Pay the minimum payment for all your debts except for the smallest one. Web the debt snowball printable uses two sheets to help you track your debt payoffs. We now understand how the snowball method works and benefits us, and we have looked into various other ways we can reduce debt. List all of your debts smallest to largest, and use this sheet to mark them off one by one. Web an example of the debt snowball. Download pro rata debt list form if you can't pay your debts in full each month, this form helps you calculate how much each creditor gets paid right now. The smallest dollar value debt you owe (credit card, card, etc) will receive all of the excess money you have left after paying the. Web debt snowball spreadsheet instructions 1. Pay the minimum payment on every debt except the sma llest. You’ll use the former to make your plan. Web the debt snowball method is a way of planning you can employ to pay off all your financial obligations. List the balance, interest rate, and minimum payment. Web first, download and print off this free printable debt snowball worksheet and then sit down and get organized. If you prefer to use a spreadsheet to track your debt payoff progress,you can grab my debt payoff toolkit here. At first, it may seem daunting, but i promise that you will see a notable change in just a few months. The smallest debt will be the one that will be getting the snowball payment. Web debt snowball spreadsheet instructions 1. Web to make it easier for you to start your debt snowball, i created a free printable debt snowball worksheet! Debt snowball spreadsheet in google docs/excel; Web debt snowball illustration & free printable debt payoff worksheet pdf. Web check out our debt snowball printable selection for the very best in unique or custom, handmade pieces from our calendars & planners shops. Free printable debt snowball worksheet; Web the debt snowball method is a way of planning you can employ to pay off all your financial obligations. Web use this debt snowball worksheet to stay organized and track the progress of your own debt payment. Pay the minimum payment for all your debts except for the smallest one. Once you’ve paid off your smallest debt, then you move up to the next smallest debt. The strategy you have developed will allow you to control finances, make. Web an example of the debt snowball. In order to do this, you will need a debt snowball worksheet and a debt snowball calculator. Web first, download and print off this free printable debt snowball worksheet and then sit down and get organized.Pay Off Debt Dave Ramsey Debt Snowball Concept Hassle Free Savings

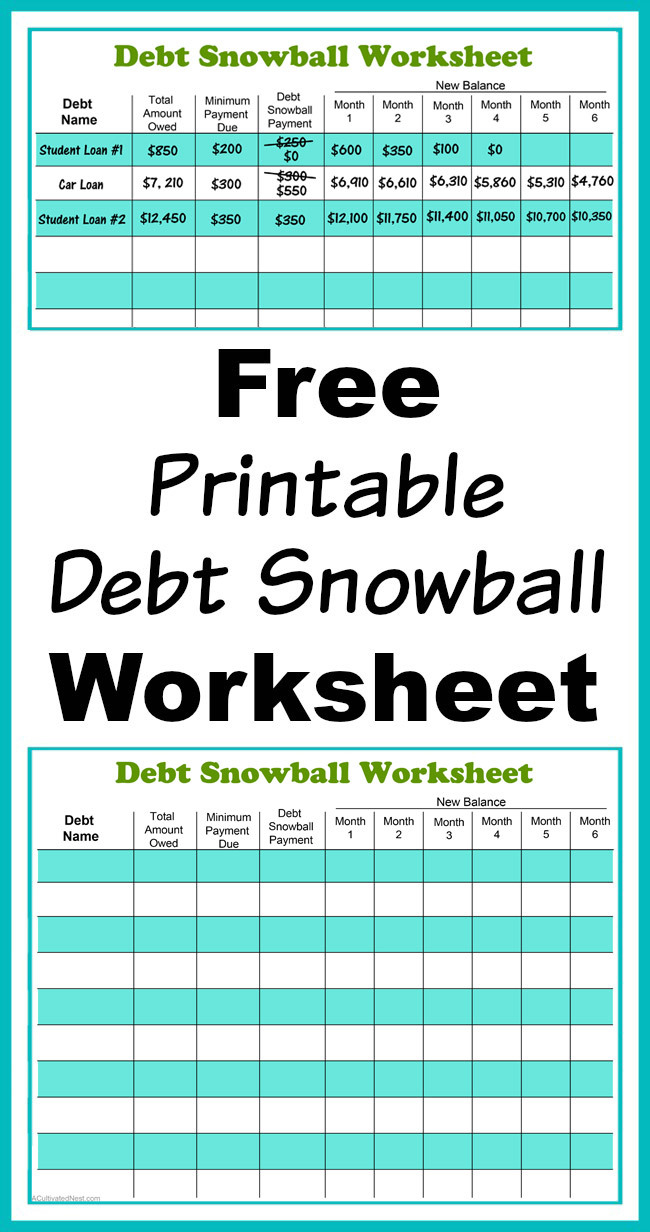

38 Debt Snowball Spreadsheets, Forms & Calculators

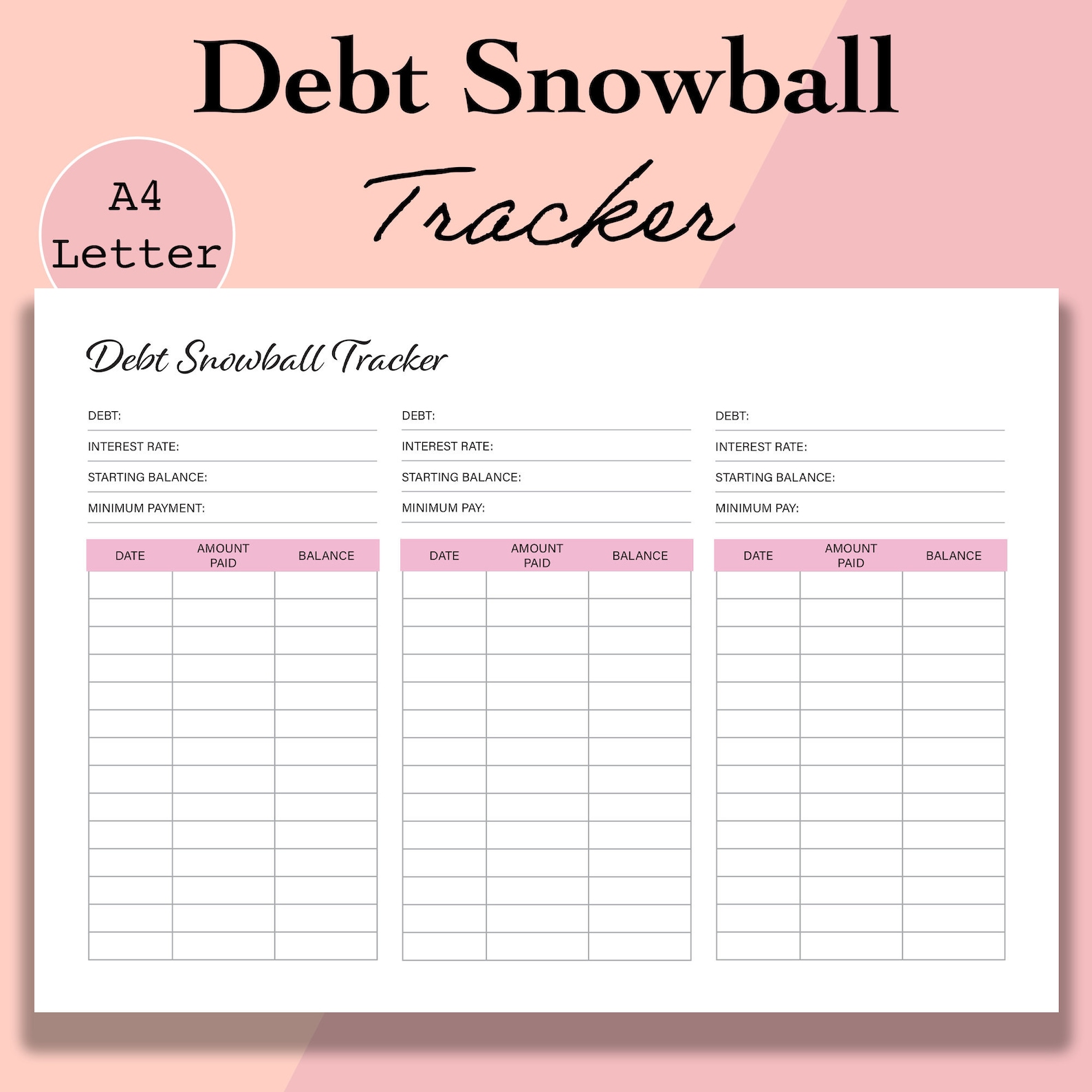

Debt Snowball Tracker Printable Debt Free Chart Debt Payoff Etsy

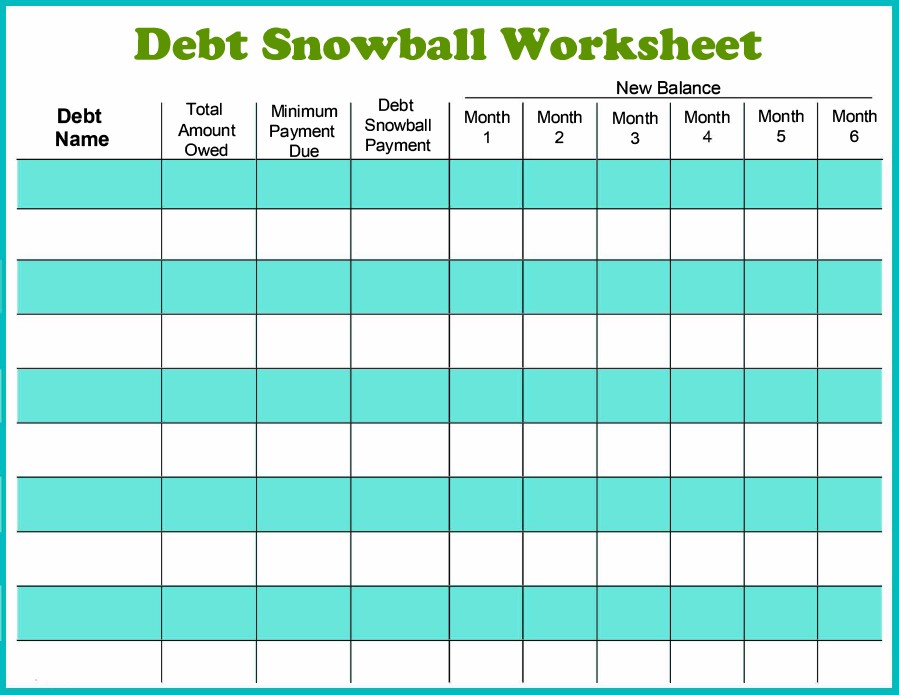

Free Debt Snowball Printable Worksheets Simplistically Living

38 Debt Snowball Spreadsheets, Forms & Calculators

Debt Snowball Printable Sheet Track Finances Reduce Bills Etsy Debt

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Etsy

130+ Free Printables to Help You Get Organized This year! Dishes and

Dave Ramsey Debt Snowball Worksheets —

Debt Snowball Worksheet Budget Printable Etsy Debt snowball

We Now Understand How The Snowball Method Works And Benefits Us, And We Have Looked Into Various Other Ways We Can Reduce Debt.

Web Free Debt Snowball Printable Tracker.

Fill Out Your Debts From Smallest To Largest.

Web Debt Snowball Worksheets.

Related Post: