8.25 Sales Tax Chart Printable

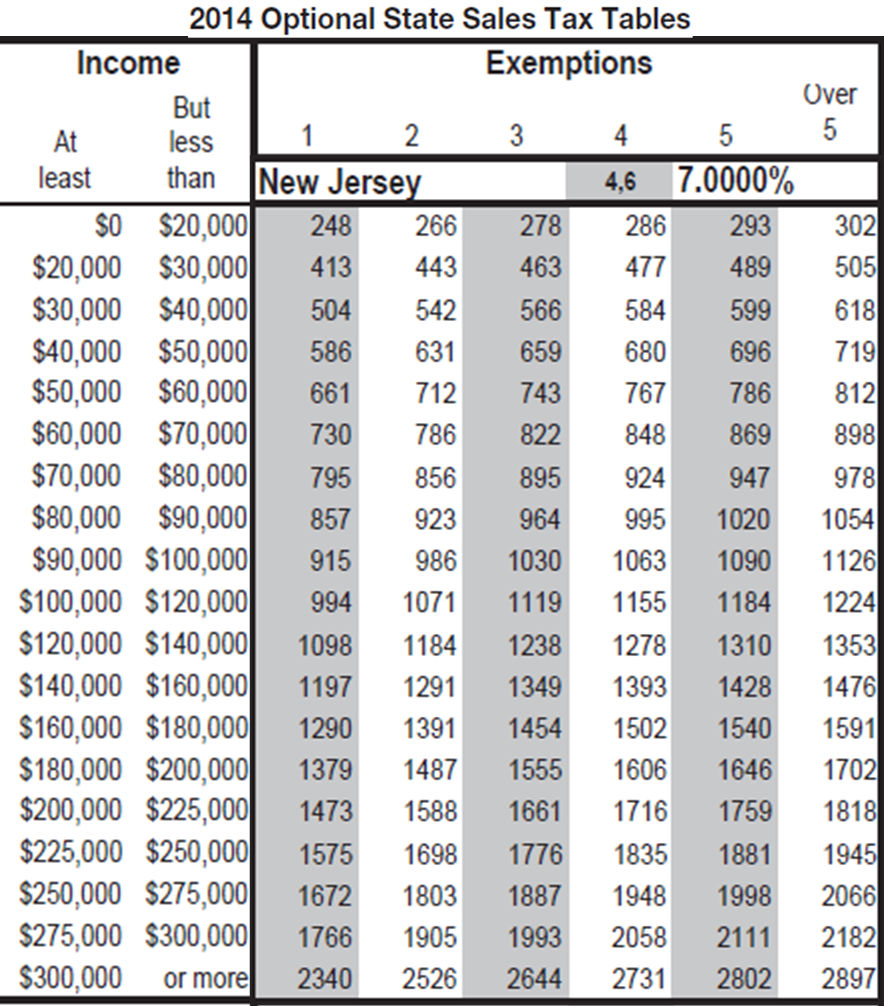

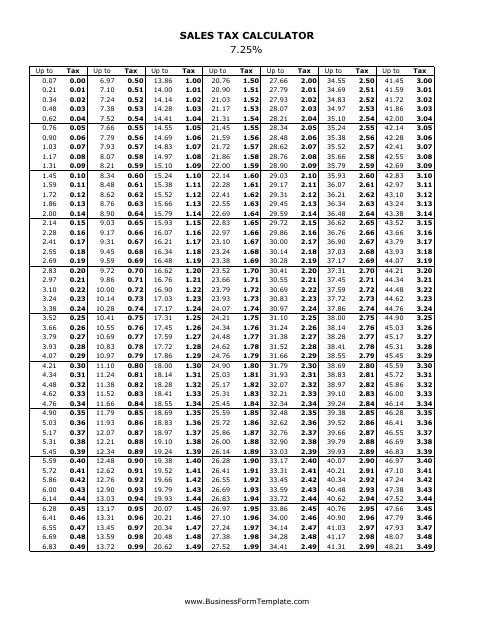

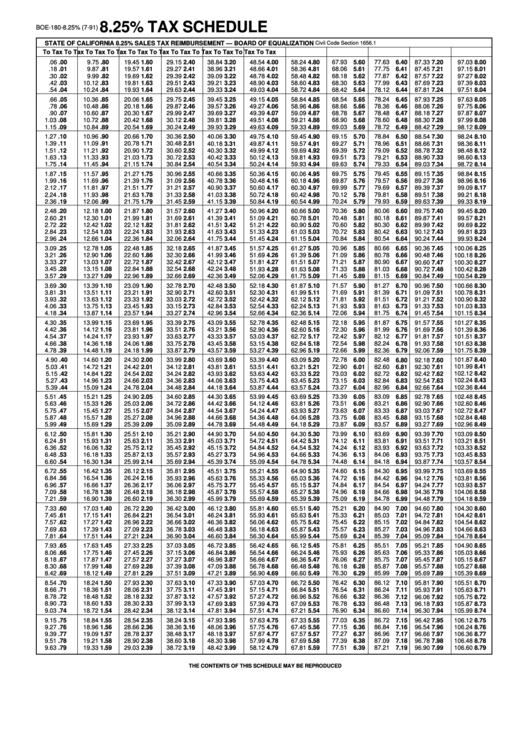

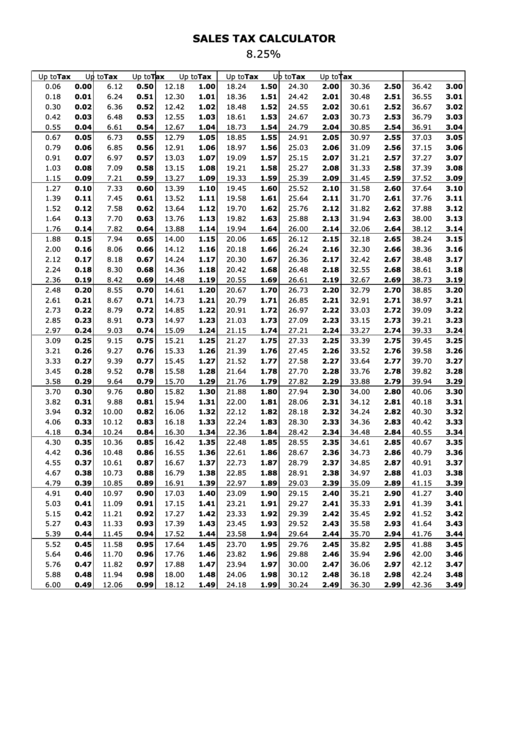

8.25 Sales Tax Chart Printable - Town of san anselmo 9.25%. You can easily calculate the tax and the final price including the tax. Enter item price and tax rate percentage to find sales tax and total price. Town of corte madera 9.00%. City of san rafael 9.25%. To use this chart, locate the row that contains the purchase price. Web here you'll find the 8.25% sales tax calculator which can be used online. Sales tax is a tax on the sale of goods and services. 303 sales tax calculator are collected for any of your needs. Web this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. Example:sale is $75.95 tax on $70.00 $5.78 tax on $ 5.95.49 total tax $6.27. Calculate sales tax and total price given your state sales tax rate. $ 60.00 $ 4.95 $ 70.00 $ 5.78 $ 80.00 $ 6.60 $ 90.00 $ 7.43 $100.00 $ 8.25 tax $150.00 $12.38 $200.00 $16.50 $250.00 $20.63 $300.00 $24.75. Town of corte madera 9.00%. Web. Town of corte madera 9.00%. $ 60.00 $ 4.95 $ 70.00 $ 5.78 $ 80.00 $ 6.60 $ 90.00 $ 7.43 $100.00 $ 8.25 tax $150.00 $12.38 $200.00 $16.50 $250.00 $20.63 $300.00 $24.75. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to. 303 sales tax calculator are collected for any of your needs. Sales tax is a tax on the sale of goods and services. Example:sale is $75.95 tax on $70.00 $5.78 tax on $ 5.95.49 total tax $6.27. Calculate sales tax and total price given your state sales tax rate. You can easily calculate the tax and the final price including. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Sales tax is a tax on the sale of goods and services. To use this chart, locate the row that contains the purchase price. You can easily calculate the tax and the. You can easily calculate the tax and the final price including the tax. Example:sale is $75.95 tax on $70.00 $5.78 tax on $ 5.95.49 total tax $6.27. City of san rafael 9.25%. Town of san anselmo 9.25%. Web here you'll find the 8.25% sales tax calculator which can be used online. To use this chart, locate the row that contains the purchase price. 303 sales tax calculator are collected for any of your needs. Calculate sales tax and total price given your state sales tax rate. Example:sale is $75.95 tax on $70.00 $5.78 tax on $ 5.95.49 total tax $6.27. Town of corte madera 9.00%. You can easily calculate the tax and the final price including the tax. Calculate sales tax and total price given your state sales tax rate. Web this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate.. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Calculate sales tax and total price given your state sales tax rate. Town of corte madera 9.00%. Example:sale is $75.95 tax on $70.00 $5.78 tax on $ 5.95.49 total tax $6.27. 303. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; You can easily calculate the tax and the final price including the tax. Web this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount. Web here you'll find the 8.25% sales tax calculator which can be used online. City of san rafael 9.25%. Town of san anselmo 9.25%. Web this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. 303. You can easily calculate the tax and the final price including the tax. To use this chart, locate the row that contains the purchase price. 303 sales tax calculator are collected for any of your needs. Town of san anselmo 9.25%. Sales tax is a tax on the sale of goods and services. City of san rafael 9.25%. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Town of corte madera 9.00%. How to figure the tax. Calculate sales tax and total price given your state sales tax rate. $ 60.00 $ 4.95 $ 70.00 $ 5.78 $ 80.00 $ 6.60 $ 90.00 $ 7.43 $100.00 $ 8.25 tax $150.00 $12.38 $200.00 $16.50 $250.00 $20.63 $300.00 $24.75. Web here you'll find the 8.25% sales tax calculator which can be used online. Web sales and use tax rates madera county 7.75%. Enter item price and tax rate percentage to find sales tax and total price. Web this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. Example:sale is $75.95 tax on $70.00 $5.78 tax on $ 5.95.49 total tax $6.27. City of san rafael 9.25%. You can easily calculate the tax and the final price including the tax. How to figure the tax. Example:sale is $75.95 tax on $70.00 $5.78 tax on $ 5.95.49 total tax $6.27. Web this sales tax table (also known as a sales tax chart or sales tax schedule) lists the amount of sales tax due on purchases between $0.00 and $59.70 for a 5% sales tax rate. To use this chart, locate the row that contains the purchase price. Calculate sales tax and total price given your state sales tax rate. Web sales and use tax rates madera county 7.75%. Price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; Sales tax is a tax on the sale of goods and services. Town of corte madera 9.00%. $ 60.00 $ 4.95 $ 70.00 $ 5.78 $ 80.00 $ 6.60 $ 90.00 $ 7.43 $100.00 $ 8.25 tax $150.00 $12.38 $200.00 $16.50 $250.00 $20.63 $300.00 $24.75.Preparer Page TY2015

7.25 Sales Tax Chart Printable Printable Word Searches

Form Boe1808.25 State Of California 8.25 Sales Tax Reimbursement

Sales Tax Calculator 8.25 printable pdf download

Printable Sales Tax Chart Portal Tutorials

Printable Sales Tax Chart Portal Tutorials

Texas Sales Tax Chart

Printable Sales Tax Chart Portal Tutorials

Regional sales tax numbers dip slightly, remain strong UCBJ Upper

New report shows Michigan tax system unfair, but reactions continue

303 Sales Tax Calculator Are Collected For Any Of Your Needs.

Web Here You'll Find The 8.25% Sales Tax Calculator Which Can Be Used Online.

Enter Item Price And Tax Rate Percentage To Find Sales Tax And Total Price.

Town Of San Anselmo 9.25%.

Related Post: